Don't fear the Fed, and stay bullish high yield. The market pricing for a March rate hike has moved up to around 90% and most EM currencies have barely bothered to notice.

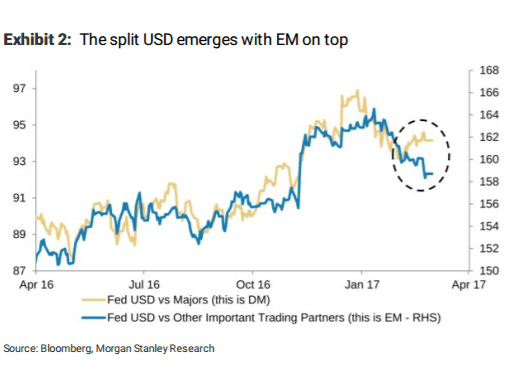

Our view of a "split USD" – i.e.a USD that strengthens against G10 currencies and to some extent low yielding AXJ, but weakens against EM currencies,and high yield EM in particular – is playing out, and we continue to recommend a strategy of being overweight/longhigh yield EM,and underweight/short low yield.

Why today's USD setup is different. In 2014, the anticipation of US monetary tightening led to USD strength particularly vs the EUR and JPY. This was a time when both the ECB and BoJ were actively guiding the markets into even easier policy paths but also the global economy was in much worse shape. USD strength was the result of a world that was thought of as being stuck in a low-growth rut and/or facing disinflationary pressures. Now, as we progress through a year that is likely to have multiple US rate hikes, past form would have suggested substantial USD strength. Instead, those economies where macro is improving amid a rebound in global trade growth and/or terms of trade gains are continuing to see exchange rate appreciation against the USD.

We expect USD to continue outperforming low yielders (EUR and JPY) while underperforming high yield EM.

Copyright © 2017 Morgan Stanley, eFXnewsOriginal Article