The Dollar continued to back off from 14-year highs as it closed yesterday’s session at 101.40, shedding as much as 1% throughout Thursday’s session (based on the DXY). A number of market headwinds may be into play at this stage; we approach the health check of the US labour market as we move into US Nonfarm payrolls data later today, we’re experiencing some unwinding of the “Trump Trade” and yesterday ADP employment change (widely considered a proxy of NFP) was softer than expected.

ADP employment for December rose by 153k, compared to a previous 215K in the previous month, and disappointing expectations of 175k. In reality we also had some positive data from the US as well. ISM services came out better than expected although in line with the previous reading, but it did little to help the Dollar sell-off yesterday.

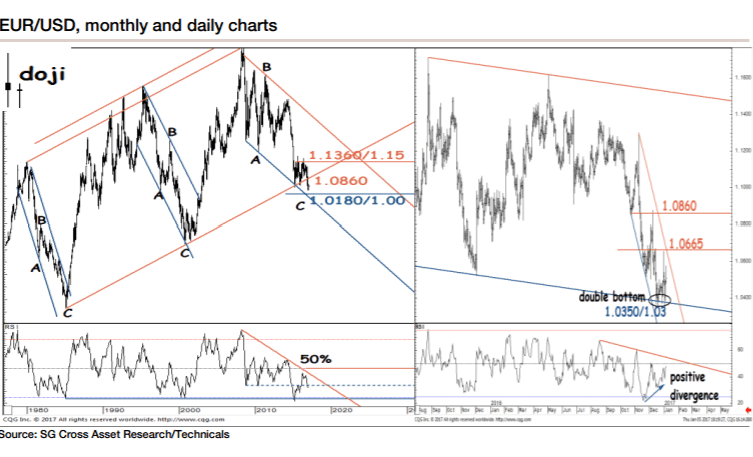

EURUSD is currently trading at 1.05826 with daily support seen at 1.0518/1.0433 and to the upside resistance at 1.0651/1.0699. Consensus figures are expecting 175k jobs to have been created throughout the month of December – we will have to wait this afternoon to see the actual figures. However despite the headwinds that this data always tends to create, we are not expecting this number to be a catalyst on the Fed’s current policy – at least not until now.

USDJPY made fresh lows going past its recent 30th December lows, and marking lows of 115.22 throughout yestertday’s session – we are currently at 115.98 as the USD takes a breather ahead of US data later today.