The US Dollar index (DXY), which tracks the USD against six of it major peers, continues to see some mild pullbacks since the start of the week after hitting 7-month highs last Friday. Expectations for a December rate hike remain in place but it is becoming increasingly tricky with a US election just round the corner and the risks to economic stability.

EURUSD is bouncing off a support zone at 1.0950:1.0970 region, and area which has seen buying come back since last June and EURUSD has tested this support at least three times in these past 3 months.

Against the Yen the USD was also weaker with the USDJPY currency pair easing off to session lows of 103.68 but remains contained above the 100-day moving average at 103.16 so far.

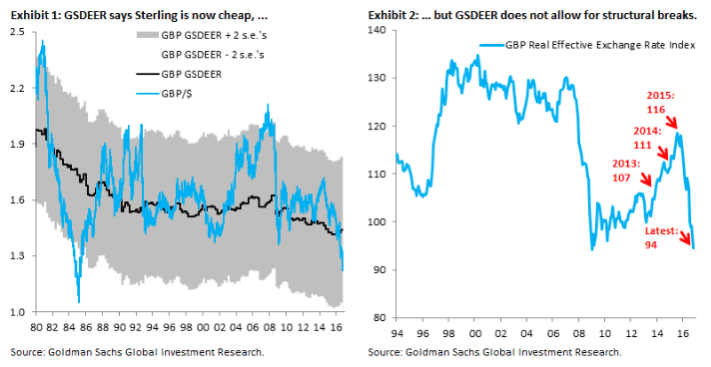

A previously ailing GBP now takes a small breather, with the British Pound at least temporarily stopping its declines against both the EUR and the USD and claws back some mild gains for the day so far.

Today’s economic docket has scheduled inflation levels for September from the UK this morning and the US later this afternoon.