Fundamental Forecast for Dollar:Bearish

The USDollar suffered its second largest weekly decline in a year this past week, but conviction was uneven

Inflation and Fed talk offered a little more traction for USD selling, but key risk in 1Q GDP and FOMC is further out

See the 2Q forecast for the US Dollar and other key currencies in the DailyFX Trading Guides

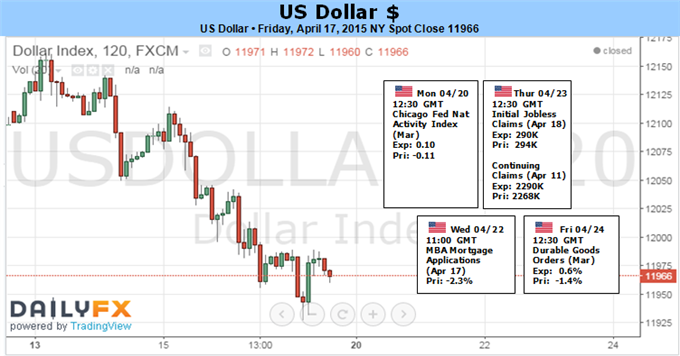

The Dow Jones FXCM Dollar Index (ticker = USDollar) dropped 1.1 percent this past week while the ICE Dollar Index tumbled 1.8 percent. That represents the second worst week for the even-weighted measure (USDollar) in 12 months and the second worst performance for the EURUSD-heavy gauge in 22 months. Have speculators over-reached on this advantaged currency? The recent stumble after two months of consolidation alongside speculative positioning suggests that may be the case. However, as market participants weigh the impetus for correction against the tangible fundamental appeal the currency holds over the longer-term; progress will lean heavily on meaningful catalysts to motivate a counter-trend move. And, this week’s docket will struggle for the high profile drivers while the period after is overstocked with redefining updates.

From a fundamental perspective, it is important to establish the longer-term position for the Greenback. Treasury Secretary Jack Lew at the G-20 noted the United States’ economic dominance when he remarked that it was not ‘sufficient’ that the US be the lone driver of global growth. That bodes well for investor returns (and thereby capital inflow) alongside the first-mover advantage the Fed seems to be taking with its relatively hawkish monetary policy standing. Furthermore, in the event of a global financial slump; the Dollar will likely revert back to its ‘haven’ status – after a certain intensity is reached. Medium to long-term, the currency looks well positioned to advance further. Yet, that doesn’t preclude it to interim corrections.

A ‘correction’ is what lurks for the Greenback. Nine-months of steady climb in the most rapid move since the early 1980’s mixes both fundamental reasoning and speculative exuberance. It is the faction that participated to take advantage of momemtum rather than hold positions to realize long-term developments that pose the currency short-term risk. It is difficult to establish exactly how much excess could be worked off, but positioning measures can act as a proxy. The CFTC’s Commitment of Traders (COT) report this past week showed a continued reversal from the record net-long exposure set in January. Now at its lowest level since the end of December, there is still plenty of room for moderation as we’ve only seen a 13 percent retreat from the bullish shift that began in 2012.

The most capable driver for the Dollar in its long and short-term course is monetary policy. This past Friday, a range of inflation measures bolstered the persistent doubt of near-term FOMC rate hikes. The headline CPI reading for March slipped back into negative territory (-0.1 percent), a real average weekly earnings figure retreated from its series high to a 2.2 percent clip and price forecasts from the University of Michigan confidence survey posted sharp declines. Caveats of robust core measures and the general trend of the wage numbers factor in, but viability of a near-term hike is certainly diminished. According to Fed Fund futures, the first hike is once again not fully priced in until January 2016.

Moderated rate expectations reinforced by tepid data, but it’s capability as a fundamental driver is diminished considering the time frame yields imply and the persistent buoyancy of the Dollar – a rate hike may come later but it is still a hike among QE programs. Sentiment may simply tip out of favor for the Greenback and pull it lower, but the most effective means would by through key event risk to focus the selling effort. For the coming week’s docket, there is limited high-profile event risk to hit all traders’ radars. And, marking a meaningful distraction, there are very high profile events in the following week (FOMC decision and GDP amongst others).

As we keep an eye on the evoluation of rate speculation, it will also be important to monitor risk trends. While extreme risk aversion would eventually buoy the USD, the aspect of its meteroric rise based in growth and interest rate expectaitons can be tripped up in initial phases of a speculative retreat.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx