The dollar eased back from a 14-year peak against a basket of its major rivals on Thursday as forex investors grew concerned by sharp falls in the dollar against the Chinese yuan.

The yuan jumped sharply for two days in a row to hit near two-month highs, catching traders off guard, that had bet on the yuan weakening further due to capital outflows from China.

Unexpectedly big falls in the dollar against the yuan had knock-on effects on the dollar against major currencies, such as the yen and the euro, as traders rushed to cut back their bets on the dollar there as well.

The dollar slipped to as low as 101.86, a three-week low, against a basket of its major rivals just two days after it touched a 14-year high of 103.82, after a strong reading from a U.S. manufacturing survey lifted the greenback.

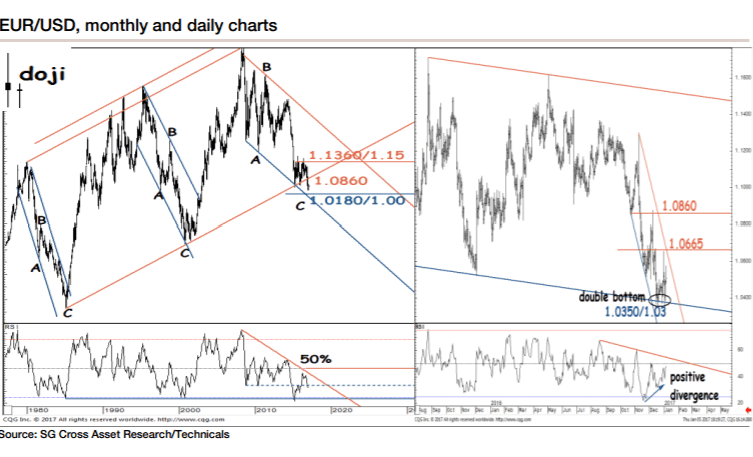

EUR/USD rose more than 0.7 percent in Asia to 1.0574, extending its recovery from a 14-year low of 1.0340 touched on Tuesday.

USD/JPY slipped more than one percent at one point to 115.55, though it has so far managed to stay above its Dec. 30 low of 116.05 and trades at 116.50.

The dollar's retreat also came as forex investors locked in profits from its two-month-old rally after Donald Trump won the U.S. presidential election. The buck had soared on Trump's plans to cut taxes, boost fiscal spending and protectionist trade rhetoric, all seen as inflationary and lifting U.S. bond yields.

Gold hit its highest in four weeks on Thursday driven by dollar weakness, staging a technical rebound. Spot gold soared around 1.5 percent to $1,179.32 an ounce.