Wall Street shares closed lower Thursday, snapping the Dow's nine-day winning streak, as oil prices weighed and the market consolidated ahead of next week's Fed meeting.

The dollar skidded from a six-week peak against the yen on Thursday after Bank of Japan chief Haruhiko Kuroda said the bank saw no need to stimulate the economy with "helicopter money".

Market participants have been speculating on an aggressive round of stimulus from next week's BOJ meeting. Kuroda talked down the idea of injecting cash directly to businesses and consumers, leading to a bout of yen strength which pushed the USD/JPY pair to as low as 105.41.

The BBC later said its interview with Kuroda was held in mid-June, and stemmed the yen's rise.

The dollar had hit a six-week peak above 107 yen before Kuroda's interview was broadcast on reports that a fiscal stimulus package from Tokyo might be as much as twice as large as previously suggested.

The euro was little changed against the dollar, easing off from its gains following European Central Bank President Mario Draghi's comments that the bank would take time to reassess any changes in the economic outlook. The ECB held off on any immediate further easing of monetary policy, as expected.

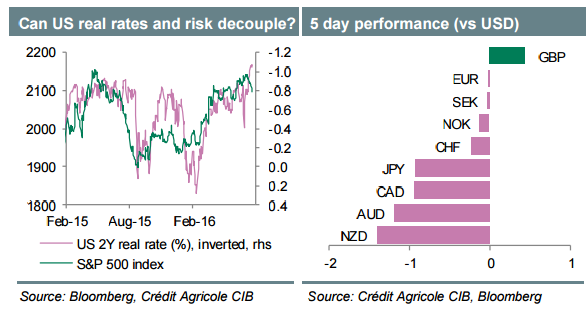

The New Zealand dollar was the biggest loser, with NZD/USD falling to a six-week low of 0.6949. It was the seventh straight session that the kiwi has turned lower.

The Reserve Bank of New Zealand used an unusual between-meeting update on policy to say further rate cuts are likely. That raised expectations for easing at its Aug. 11 meeting.