The dollar retreated on Wednesday as forex investors booked profits following its sharp rise against the yen after intervention warnings from Japanese policymakers.

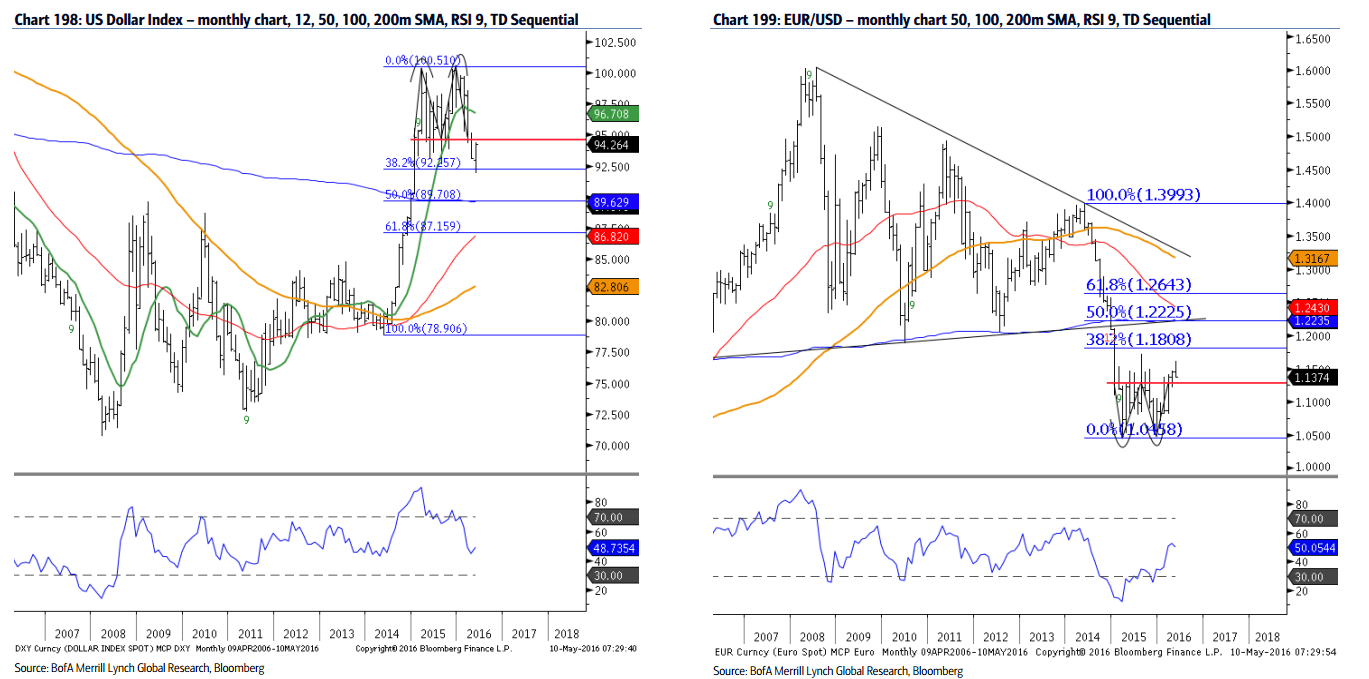

The Dollar index, which tracks the greenback against a basket of six rival currencies, slipped more than 0.25 percent to 94.05, edging away from its two-week peak of 94.356 set overnight. It remains however well above a 15-month low of 91.919 hit on May 3.

USD/JPY shed more than half a percentage point, dropping to 108.50 after rising to a two-week high of 109.38 early in the Asian session. It moved back toward last week's low of 105.55, which marked its lowest since October 2014. EUR/JPY dropped more than 0.40 percent to 123.60 after touching a two-week high of 124.415 overnight. The pair hit a three-year bottom of 121.48 on Friday.

Recent dovish comments from core Federal Reserve members and weaker-than-expected job gains in April continue to cap the dollar. EUR/USD added 0.1 percent and trades at 1.1385 at the time of writing, but remains well below its 2016 peak of 1.16160 hit on May 3.

The Aussie slipped about 0.4 percent to 0.7338 against the buck edging closer toward a two-month low of 73 cents touched on Tuesday, as oil prices gave up their overnight gains.

The kiwi gained some respite as the RBNZ said it would introduce new measures to curb Auckland's housing market and said it would address risks to its ailing dairy sector. NZD/USD rose to 0.6842, climbing well away from a recent low of 0.6717.