Last week US President Trump was not able to push the healthcare bill (that was expected to supercede Obamacare) for a vote but instead opted to ditch the bill. Taking down Obamacare was one of Trump’s flagship promises and he pledged to that immediately. In fairness Obamacare had taken months of discussions and negotiating and managing to push this bill in a few weeks seemed quite a feat.

However this episode twinned to the legal kick backs of the recent travel ban cast a doubt on Trump’s ability to forge the right policies with the right details.

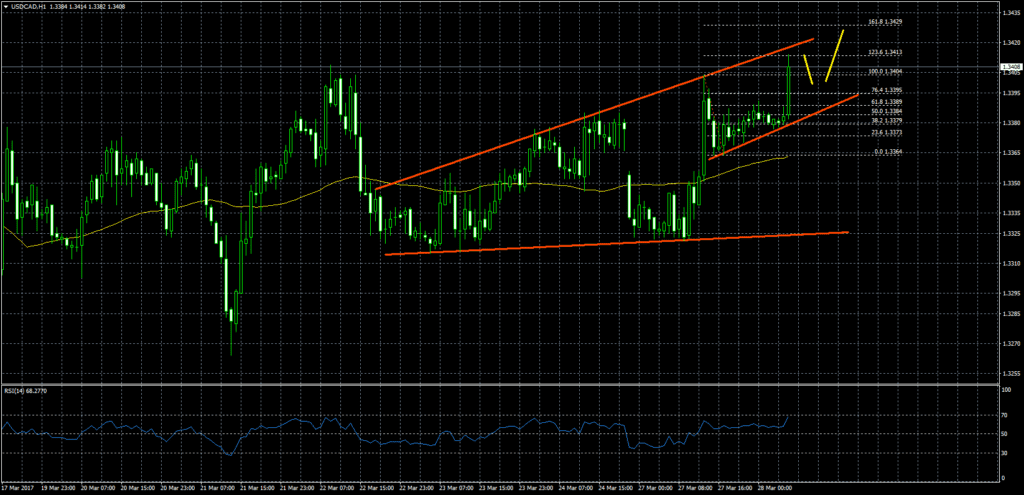

This is swiftly being translated in USD weakness this morning. The USD is down across all its major peers, and the US Dollar index measuring the strength of the USD against its major peers, has gapped down to a current 99.28 this morning already.

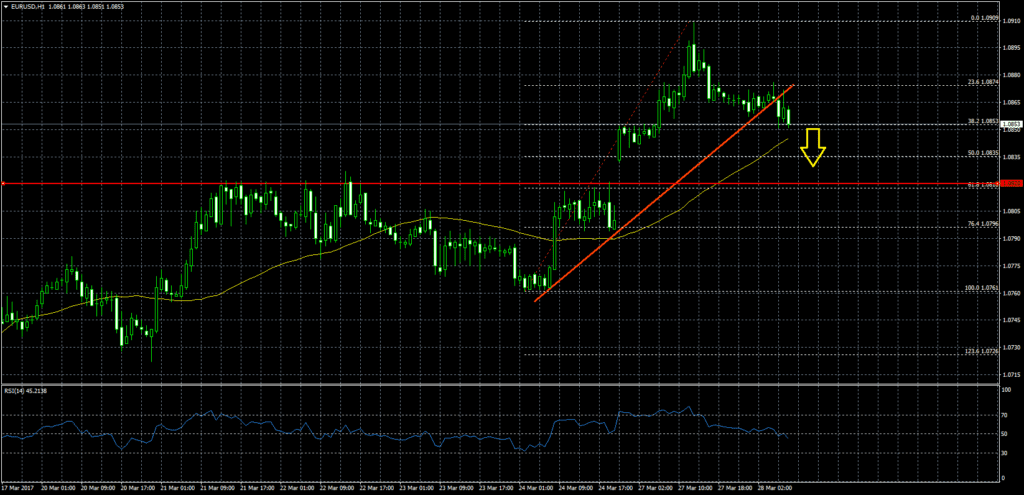

EURUSD is fast approaching the 200DMA at 1.0884, after gapping to 1.0833 this morning (Friday we had a close of 1.0796).It is likely that the gap will have to be closed at some point, but not before attempting higher it seems.

This morning we are expecting IFO numbers from Germany, in the afternoon the Dallas Fed Manufacturing Activity but other than that markets are likely to be driven by sentiment rather than economic data.