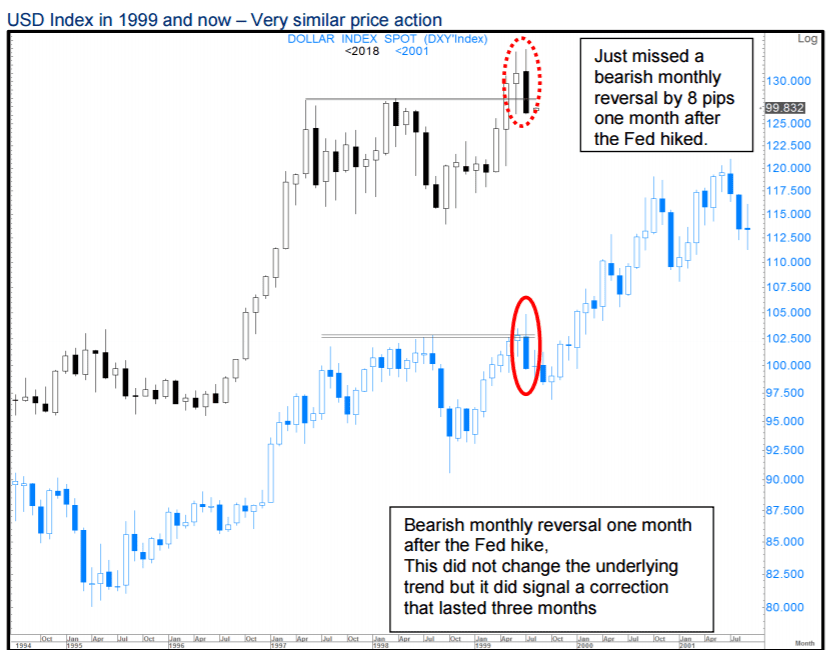

Despite its weekly losses, at least so far, the US Dollar has managed to consolidate just below 100 levels on the US Dollar index (DXY). Yesterday the index hit 11-week lows at 99.23. The US Dollar is currently taking a breather ahead of US Nonfarm Payrolls scheduled for this afternoon. Consensus expectations point towards a creation of 168K jobs throughout the month of January and no change to the current unemployment rate of 4.7%.

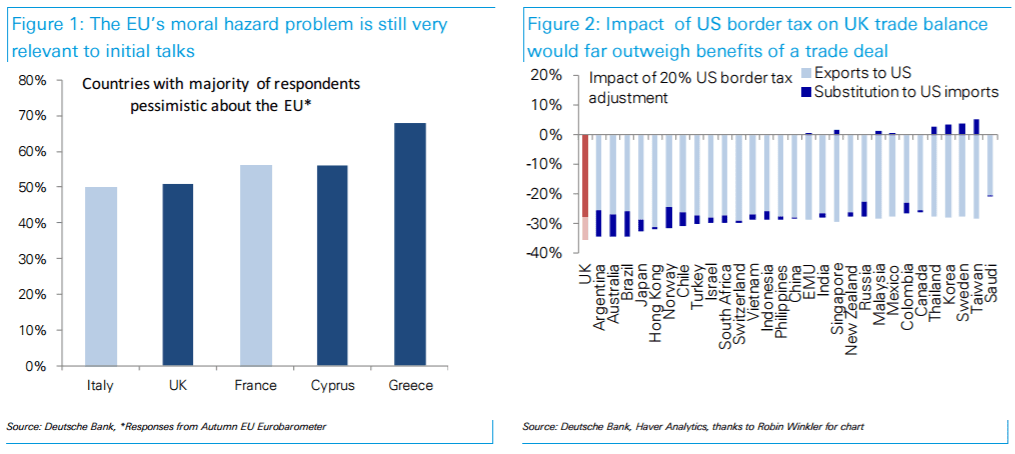

Beyond the monetary policy the US Dollar seem to now looking at Trump’s polices and the geo-political risks that keep stirring in the background.

As a preliminary gauge of sentiment, it seems that the mood in Asia was predominantly negative as China rejoins the markets following its week break.

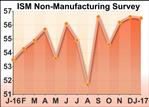

In today’s economic docket the highlight goes to the Nonfarm payrolls from the US, but we also have ISM non-Manufacturing, Factory Orders and Durable Goods out of the US as well. Throughout the EZ session we are also expecting PMI numbers and retail sales figure for the month of December.

EURUSD is currently trading at 1.0755 but the trend of higher highs and higher lows, since year start, suggest that the pair may be eyeing next horizontal support around 1.0880 in the near term. However for now the daily chart depicts no trend with ADX, measuring the strength of the trend, remains neutral.