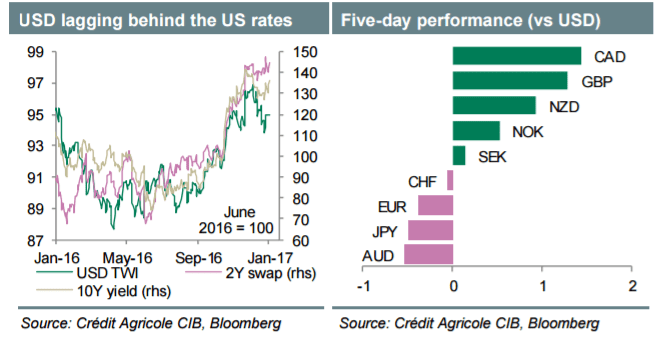

The dollar edged up on Friday, bouncing back from a seven-week low on optimism over the U.S. economic outlook and corporate earnings. Meanwhile the Mexican peso plunged after the White House floated the idea of a 20 percent tax on Mexican goods to pay for a border wall.

The dollar index, rose 0.2 percent to 100.57. The index had recovered overnight to hit 100.73, after dipping to a seven-week low of 99.793. The buck is lifted by rising Treasury yields and solid equities. It could however come under pressure as potential new trade barriers may continue to weigh.

Forex investors grew increasingly concerned about Trump's plans to construct a U.S.-Mexican border wall to stem illegal immigration. Mexican President cancelled next week's meeting with Trump following a spat on Twitter between the two leaders. The White House said on Thursday that Trump proposed a new 20 percent tax on goods from Mexico to pay for the wall.

The Mexican peso fell 0.6 percent against the dollar following the news, and stepped back from Thursday's three-week high of 20.8645. USD/MXN rose to 21.37 overnight.

USD/JPY rose more than half a percentage point above 115. The greenback rose to a high of 115.30 yen on Friday after the Bank of Japan announced an increase in five- to ten-year Japanese Government bonds purchases and helped bring down yields from 11-month highs.

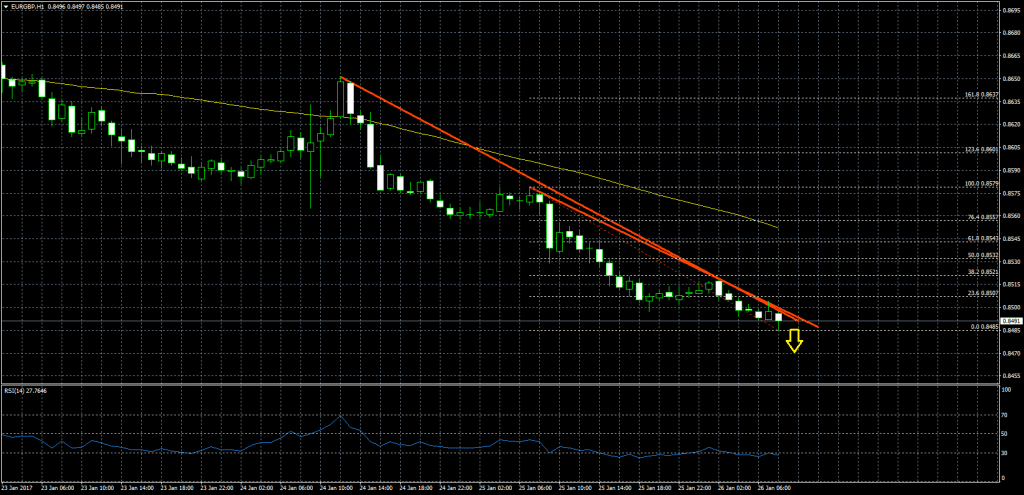

EUR/USD nudged up to 1.0695, after dipping test the previous day's low by 1.0658. Traders' focus will turn to U.S. fourth-quarter gross domestic product estimates due later in the day.

GBP/USD slipped to 1.2529 overnight, but is still on track to finish the week higher. It had gained 5 percent in two weeks, recovering from a three-month low of 1.1983 hit on Jan. 16.

British Prime Minister Theresa May will be the first foreign leader to meet the new U.S. President later in the day. May called on Trump to renew the "special relationship," expecting a rapid trade deal and close economic ties between the two countries.