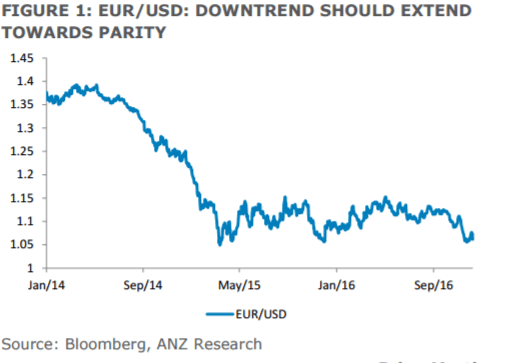

The US dollar sustained its large gains against the yen and euro early on Friday, after the single currency plummeted yesterday following the European Central Bank's decision to extend its debt-buying program despite cutting the amount of purchases.

The ECB said Thursday it would taper its monthly asset buys to 60 billion euros as of April, from the current 80 billion euros. The euro had spiked to a near 1-month peak as the move was seen as a form of policy tapering.

The common currency quickly retreated from its highs as the central bank's decision to extend bond purchases to December from March and expanded what it could buy to shorter-dated paper. That nullified any lift from the reduction of its debt buying amount.

The ECB also said it reserved the right to increase the size of purchases again.

EUR/USD traded around 1.0616, close to yesterday's close following its brief surge to near 1-month high of 1.0875 yesterday. It fell 1.3 percent on Thursday, the biggest intraday loss since late June.

The 2-year German bund yield sank on Thursday while the 10-year bund yield rose as long-dated debt were sold on the ECB's decision to reduce the buying amount while widening the overall maturity range of its purchases.

USD/JPY was firm at 114.45 after going as low as 113.120 on Thursday prior to the ECB decision.

U.S. equities closed higher on Thursday, notching fresh record highs, as a post-election rally continued following a key monetary policy announcement from the European Central Bank.