The dollar rose to seven-week highs versus its rivals on Friday, lifted by hopes for progress on U.S. tax reforms, while cable was under fire on concerns over a possible leadership feud in the British government.

Congressional Republicans were looking to speed up an overhaul of the U.S. tax code on Thursday, with the Republican majority in the House of Representatives leading the way to approve a fiscal 2018 spending plan to help advance an eventual tax bill.

With China’s Golden Week ending on the 8th, Chinese markets are still expected to remain quiet until the Communist Party Congress meeting that starts the 18th. Chinese authorities are tightening security and maintaining stability in the run-up to the once-in-five-years meeting that will involve a leadership reshuffle. China undertook a series of market reforms in the last three decades that propelled the Communist country to the spot of the world's second largest economy.

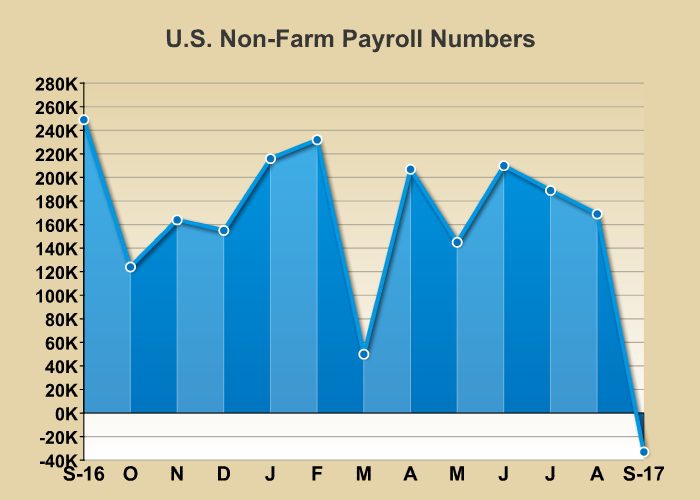

Today forex traders will focus on US non-farm. ADP Non-Farm employment was close to the expected figure in September but much lower than August, showing only 135K versus 228K in August. Today’s Non-farm data may provide mixed signals. The impact of Hurricane Irma should weigh on the outcome; however all readings should be seen as reversible and will have limited impact of the Fed’s December rate hike decision.

FOMC Members were hawkish this week, non-voting member Williams and member Harker continue to favor a move, FED Chair candidate Powell refrained from expressing any views on monetary policy, focusing more on regulatory aspects of central banking.

Canadian employment change is expected to show 13.9K more employed people since the end of August. Last month revealed 22.2K jobs added.

EUR/USD fell to 1.1685 overnight, while GBP/USD traded down to 1.3061. Gold was also under pressure, slipping to 1267.19.