On Thursday, the US dollar dropped against the basket of major currencies after 7 consecutive days of gains, as investors locked in profits on a day with no major US economic data. Moreover, the currency was also under downward pressure from global stock market slump.

However, the greenback has surged strongly lately against its Japanese counterpart. The Yen’s recent depreciation has help stop the run of gains that pushed it to the highest level in 18 months versus the dollar early this month.

Investors have been turning their focus to the pound sterling as the BOE monetary policy meeting and Quarterly Inflation Report are scheduled for today. With the U.K. referendum on continued EU membership right around the corner, the BOE has a lot to consider this month with three specific issues to be focused on – growth, inflation and Brexit.

The New Zealand dollar on the other hand extended its gains after the Reserve Bank of New Zealand expressed urgent concerns about house prices in Auckland. Although the central bank also expressed concern about lower dairy prices, the greater issue seems to be high house prices. This indicates a reduction in chances of any near term easing by the Reserve Bank – hence the rise in kiwi.

Oil prices lost traction early Thursday on profit-taking, reversing a sharp rise from yesterday when the U.S reported an unexpected fall in crude inventories, and continuing supply outages in Canada and Africa. International Brent crude futures were at $47.47 per barrel today, down 13 cents from their last settlement.

According to a World Gold Council report released earlier today, global demand for gold surged 21% in the first quarter of 2016, compared with the previous quarter. Gold currently trades at $1270.66/ounce, 0.5% lower than the previous close.

Technicals

EURGBP

EURGBP has been moving sideways for a period of time and has retested the level 38.2% of Fibonacci retracement many times. This level is still holding and seems to have turned into a solid support for prices. A green arrow has just appeared under the price chart, signaling a buying position. The uptrend is also confirmed as ADX (14) stands at 27.4246.

Trade suggestion

Buy Digital Call Option at 0.79175 valid until May 16, 2016

Buy Digital Put Option at 0.78928 valid until May 16, 2016

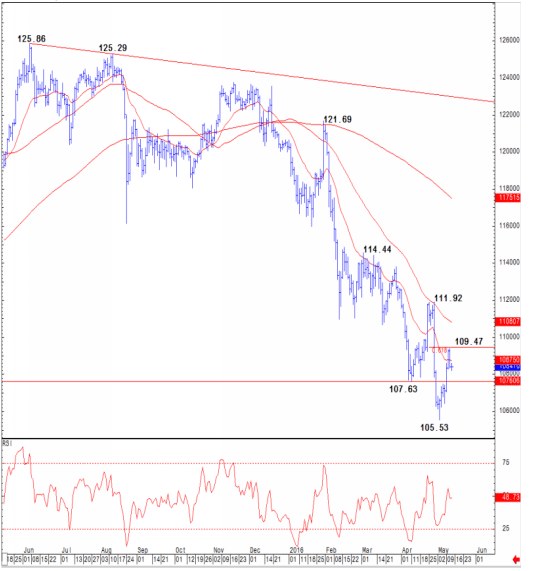

USDJPY

The USD is tracing an up-move against the yen after the pair USDJPY reached the support of 108.197. RSI (14) is at 62.2429, indicating that the bull is ahead. Hence, the price is supposed to continue climbing up and may break the resistance of 109.360 formed two days ago. The signal trend indicator is currently suggesting a long position.

Trade suggestion

Buy Digital Call Option at 109.010 valid until May 16, 2016

Buy Digital Put Option at 108.690 valid until May 16, 2016

NZDUSD

After hitting the lowest level of 0.67142 in one and a half month, the pair NZDUSD has since bounced back, trimming the losses. However, the red arrow hanging above the price chart still implies a selling position. The pair is anticipated to swing around the level 38.2% of Fibonacci retracement in the short-term and could then return to the current downtrend.

Trade suggestion

Buy Digital Call Option at 0.68183 valid until May 16, 2016

Buy Digital Put Option at 0.68036 valid until May 16, 2016

SILVER

Yesterday, SILVER broke the ten-day old downtrend and has been moving sideways since. RSI (14) hovers around the average, indicating that the price may continue the stable trend for a while before surging up. A green arrow has appeared under the price chart, encouraging a buying position.

Trade suggestion

Buy Digital Call Option at 17.375 valid until May 16, 2016

Buy Digital Put Option at 17.306 valid until May 16, 2016

COPPER

COPPER is heading up for some consolidation from the support of 2.0888, the one-month low. The price may pull back soon as the signal trend indicator still indicates a down-move for the commodity. The level 23.6% of Fibonacci retracement is expected to turn into a support area for the price. Bears still look strong.

Trade suggestion

Buy Digital Call Option at 2.1259 valid until May 16, 2016

Buy Digital Put Option at 2.1178 valid until May 16, 2016

FTSE

FTSE opened today’s trading with a wide gap and is currently covering the gap. The signal trend indicator signaled a short position since April 25, with a gain of 16165 points up to now. This is a considerably large move for the index, hence, a reversal into an uptrend is expected to happen after the price tests the support at 6052.66

Trade suggestion

Buy Digital Call Option at 6125.9 valid until May 16, 2016

Buy Digital Put Option at 6074.5 valid until May 16, 2016