On Tuesday, the Australian dollar gained after the Reserve Bank of Australia (RBA) decided to keep the interest rate unchanged, along with hinting that there was no urgency to further ease the monetary policy due to strong economic growth. As expected, the RBA maintained the rate stable at a record low of 1.75%, sending the Aussie higher. Today, the currency retreated slightly to $0.74423 after reaching a one-month peak at 0.74630 yesterday.

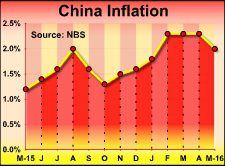

On Wednesday, the World Bank has reduced its global growth forecast for 2016 to 2.4% from the earlier estimates of 2.9% in January, due to low commodity prices, weak demand in advanced economies and capital flows. The bank maintained China’s growth forecast unchanged at 6.7% this year after 2015’s 6.9%. It also predicted that growth in the world second largest economy will slow down to 6.3% in 2018.

After hitting a one-month high at 0.6982 on Tuesday, the Kiwi was last trading at $0.6977. The New Zealand central bank will announce its monetary policy decision on Thursday. It is anticipated to hold the rate at a record low of 2.25 percent on the recent stabilization in inflation and some cooling off in speed of growth in housing prices.

Oil prices stayed steady near the highest level in around 8 months today, supported by expectations of a large drawdown in the US crude inventories and worries about the attacks on Nigeria’s oil industry. In particular, US crude oil inventories are expected to drop by 3.2 million barrels this week, following the 1.4 million barrel fall the week before. Nigeria’s oil production was brought to the lowest level in 20 years due to militant attacks on oil and gas pipelines.

Gold stood near the two-week high on Wednesday against the weaker dollar, rallying sharply after disappointing nonfarm payrolls data, with only 38,000 jobs created during May compared with April’s 123,000. Gold has climbed nearly 4% since the release of the employment data.

Technicals

USDCHF

USDCHF has dropped continuously from the resistance level at around 0.99583 and is now trading at the one-month low of 0.96473. Although the pair is in the oversold zone with RSI staying at 19.8, further market movement to the downside continues receiving some support from the movement of the two MA’s above. The short-term MA100 is very likely to cut the long-term MA200 from above. However, as the price is facing a solid support at 23.6% Fibonacci retracement, a consolidation is expected ahead of another steep plunge.

Trade suggestion

Buy Digital Put Option from 0.96470 to 0.96212 valid until 20:00 June 10, 2016

EURJPY

EURJPY is trading at around 121.832, under the pressure of the short-term moving average above. ADX is at level 31, combined with DI- (red line) crossing DI+ (green line), suggesting a strong bear trend. RSI is lingering below level 50, indicating that no clear direction has been formed yet. The pair is anticipated to witness slight gains to test the levels around 122.164 before pulling back.

Trade suggestion

Buy Digital Put Option from 122.164 to 121.395 valid until 20:00 June 10, 2016

AUDNZD

In general, AUDZND is in a downtrend with the current price at 1.06681. The DI- (red line) has just crossed the DI+ (green line) and is heading up, suggesting a dominance of sellers. With RSI staying around level 52 and pointing down, the pair is expected to continue its bearish movement, retesting the support level at 1.06167, created on May 23, 2016.

Trade suggestion

Buy Digital Put Option from 1.06584 to 1.06167 valid until 20:00 June 10, 2016

GOLD

After soaring from around 1210.99, the gold price has been moving sideways around the area of Fibonacci retracement 50.0% with the support of the parabolics sar band below. The commodity is in the overbought zone as RSI’s reading is above level 70. The buying power still seems strong, which may push the market further. The price is expected to hit the zone of Fibonacci 61.8.

Trade suggestion

Buy Digital Call Option from 1247.57 to 1254.85 valid until 20:00 June 10, 2016

WTI

WTI is on track to rise as high as $50.90 per barrel with the parabolics sar band support below. The commodity is about to enter the overbought territory with RSI hovering around level 68 and heading up. The ADX is now at level 42, along with DI+ (green line) far higher than the DI- (red line), signaling a strong bullish trend. The up-move is anticipated to last for another 2-3 trading days, after which a pull back may occur.

Trade suggestion

Buy Digital Call Option from 50.36 t0 51.04 valid until 20:00 June 10, 2016

DAX

DAX has just retreated from the resistance level at around 10314.47. The index is moving sideways around the area of Fibonacci retracement 61.8% currently, with RSI lingering at level 56 and pointing down. Lower highs have been formed, not to mention the trend indicator’s selling signal that appeared last week, suggesting short positions. The price is expected to break through the 61.8% and reach the Fibonacci 50.0% area.

Trade suggestion

Buy Digital Put Option from 10314.47 to 10197.25 valid until 20:00 June 10, 2016