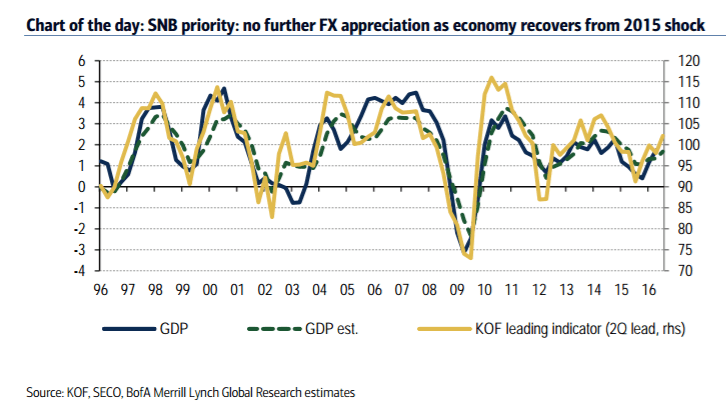

Our baseline scenario remains that the SNB's preferred policy tool is ad-hoc FX interventions to fend off currency appreciation while keeping the threat of further deposit rate cuts alive. However, we think the US election outcome has increased risks of another SNB deposit rate cut from -75bp currently to -100bp.

We believe the trigger of such a move will be the pace and persistence of currency interventions the SNB needs to run to avoid CHF appreciation. Weekly domestic sight deposits data will be our earliest indicator of SNB pressure. If they exceed peak increases since 2015, we think rate cuts could become a serious option.

Meanwhile, the Swiss government's deadline to implement laws to cut immigration by February 2017 is approaching. In principle, limiting EU immigration stands at odds with free movement of labor and could potentially damage Swiss-EU bilateral trade relations. The current draft is "preferential treatment light", essentially forcing Swiss employers to consider Swiss applicants, rather than setting hard caps. This draft will go through parliament before year-end. EU officials have notcommented yet; we believe risks remain.

….The SNB continues to reiterate its now well-worn mantra that the CHF is "significantly overvalued" and that it stands ready to intervene should circumstances dictate. These comments have ceased to have any meaningful impact and whileour own valuation metrics continue to view CHF as an overvalued currency, the analyst community has become less convinced the CHF is on the path to meaningful depreciation over the coming years. Chart5 highlights how analysts have progressively lowered their end 4Q17 and 4Q18 projections for EUR/CHF. In other words, the expectation of sustained CHF depreciation is now less of a consensus view than it was following abandonment of the EUR/CHF peg. While the contours of our own EUR/CHF profile looks for appreciation over the coming year, the anchor for that view is our fair value estimates suggest the CHF remains overvalued.

Copyright © 2016 BofAML, eFXnews™Original Article