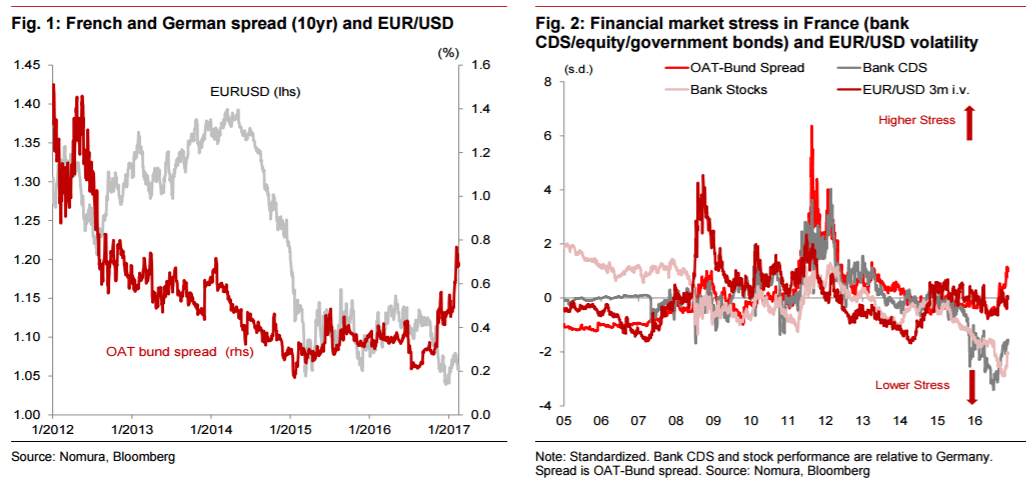

We continue to expect the SNB to smooth the downside in EURCHF but only to manage volatility and no longer to manage a level.

In times of market uncertainty in the Eurozone and peripheral spread widening, we would look to sell EURCHF as a political hedge.

After last week's referendum, the Swiss government is now going to have to come up with another way to limit the tax income reduction for the Cantons, which may eventually fall onto the SNB.

MS targets EUR/CHF at 1.06 by the end of Q1, and at 1.05 by the end of Q2.

Copyright © 2017 Morgan Stanley, eFXnewsOriginal Article