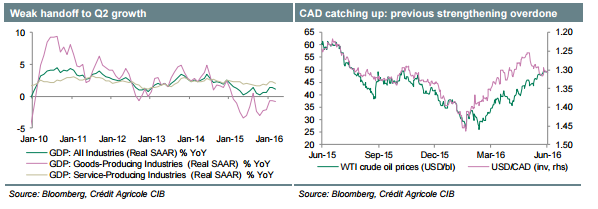

With more negatives in the price, we expect CAD to stay sensitive to incoming data. Stretched long positions also expose the currency to additional position squaring risks

Datawise, the focus is on May employment data. Any signs of recovery in manufacturing jobs will be noted as the recent weakness is at odds with Canada’s desired export resurgence. Limited job growth elsewhere such as in service-providing industries would lead to greater concern over domestic demand conditions in addition to the under-performing external sector.

When it comes to the economic outlook, downside risks remain intact, keeping CAD a sell on rallies.

Copyright © 2016 Credit Agricole CIB, eFXnews™Original Article