It’s been a rough ride for the loonie in October. The rally in oil prices didn’t translate into strength for the Canadian dollar, while hawkish Fed communications have been gradually pushing the loonie weaker.

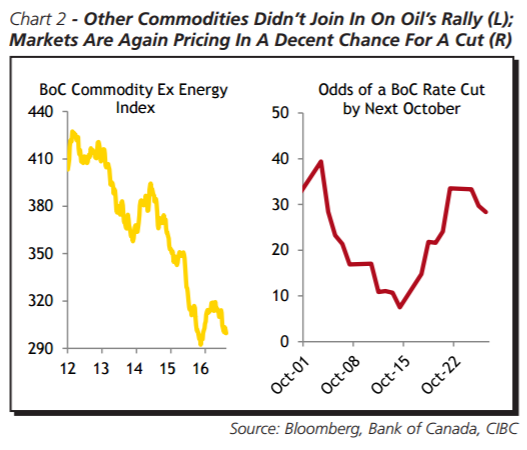

But, the biggest blow came from the Bank of Canada, as Governor Poloz mused about the possibility of adding further stimulus at the last fixed announcement date. While higher oil prices have likely shielded the loonie from an even worse showing over the past month, the relationship between the currency and crude has been less pronounced than previous moves. That’s because the rally was supply driven, and other commodities didn’t join in on the fun (Chart 2, left). As we had expected the Bank of Canada revised down its forecasts for growth over the next couple of years and indicated that a rate cut is certainly on the table should growth disappoint further.

Together with a US rate hike in December, we now see the currency finishing the year at 1.37, slightly weaker than our already bearish previous forecast. At this point, we still see incoming fiscal stimulus keeping the BoC on the sidelines, but it will be a narrow miss. That will see loonie weaken to the 1.39 level in Q1 before rebounding slightly as rate cut expectations are reduced later in the year.

Copyright © 2016 CIBC, eFXnews™Original Article