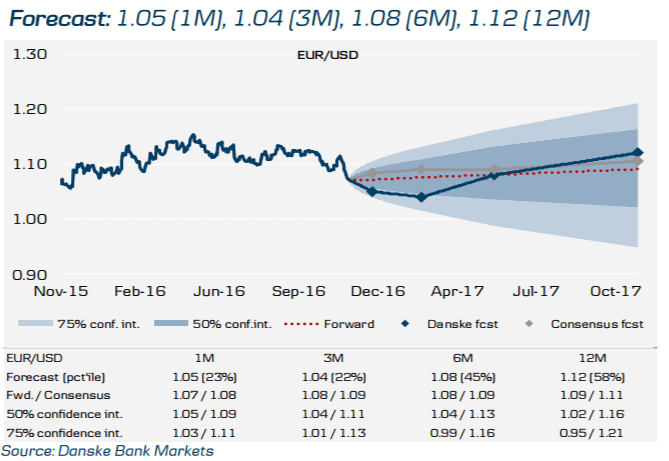

We expect a front-loaded depreciation of the loonie (USDCAD: 1.37 in Q4 16), with some moderation by the end of 2017 (to 1.42).

We expect Canada to be less affected than Mexico by the possible imposition of US anti-globalization policies, including renegotiating or rescinding NAFTA, but indirect effects may be greater than many realize, and uncertainty surrounding Trump’s policy choices is likely to weigh on the CAD.

Monetary policy divergence and widening interest rate differentials are likely to weigh on the loonie as well, since we continue to expect the BoC to stay on hold for the foreseeable future, although the risk is for additional easing. Oil prices could offer some support next year as the market slowly rebalances.

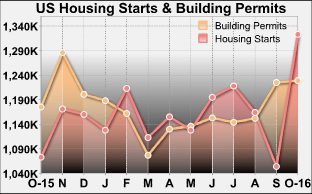

On the other hand, a fiscal expansion in the US that relies heavily on infrastructure spending can improve US growth and increase the demand for Canadian exports (particularly raw materials), absent any significant restriction to bilateral trade. In that case, the CAD could be better supported coming into 2018, allowing for appropriate policy lags.

Barclays' forecasts last updated on eFXplus on Nov 17.

Copyright © 2016 Barclays Capital, eFXnews™Original Article