The Australian dollar edged lower on Tuesday as forex investors braced for the possibility that the central bank may signal an imminent easing at its review later today. Meanwhile the safe-haven yen got a lift from worrying signs in China's service sector.

Trading was subdued with no directional clues as US markets were shut down due to the Independence Day holiday.

USD/JPY fell 0.4 percent at 102.09, while the euro dropped 0.7 percent to 113.63 yen. AUD/USD slipped 0.3 percent to 0.7511, though it remained within site of Monday's more than one-week high of 0.7545.

The Reserve Bank of Australia is widely expected to leave rates unchanged as it awaits second quarter consumer price data due on July 27, but market participants are betting on a cut in August given low inflation and uncertainty following Britain's vote to leave the European Union.

GBP/USD slipped more than 0.3 percent to 1.3211 on renewed concern over consequences from Brexit, but remained above last week's 31-year trough of 1.3122 plumbed in the wake of the Brexit vote.

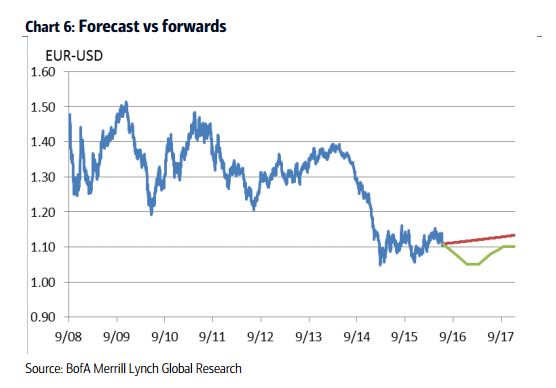

The US dollar index, which tracks the greenback against a basket of six rival currencies, edged down slightly to 95.626. EUR/USD inched down 0.2 percent to 1.1130.