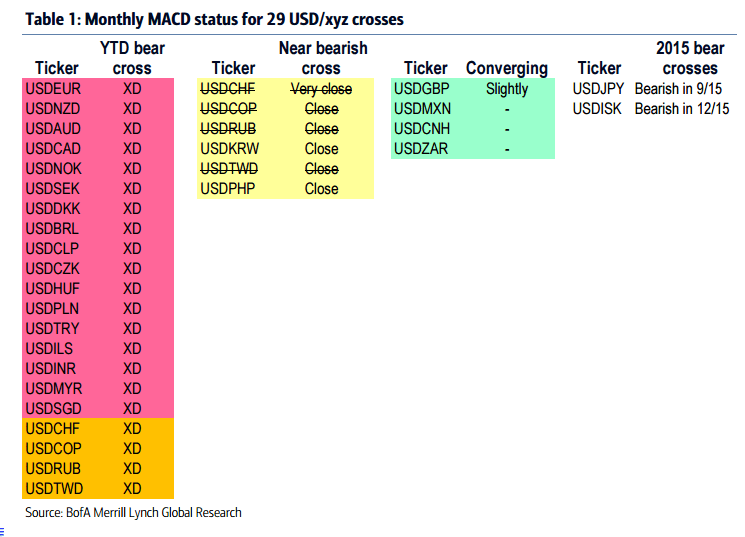

Near the end of April we reported that 17 of 29 USD currency pairs had bearish monthly MACD signals, with most of them occurring in March or April. The volume of signals in such a short time combined with strong May seasonal patterns led us to anticipate a bounce in May. The DXY ended May up 3%; however, Table 1 shows four more bearish crosses have occurred, bringing the YTD bearish monthly MACD crosses to 21 of 29.

The MACD’s of USD/CHF, USD/COP, USD/RUB and USD/TWD crossed bearish. Including the latter half of 2015, there are a total of 23 that are bearish. Two more crosses are near a bearish cross. One cross has converging MACD lines and three are no longer converging.

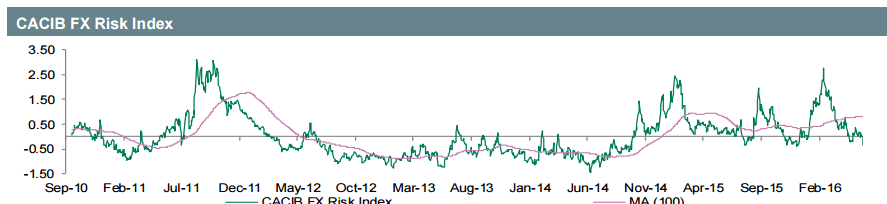

A tactical rally could lead to resistance at 96.80 Price has rallied off the 38.2% retracement, the weekly MACD is crossing up and momentum as shown by RSI didn’t break to a new oversold low.

In the short term, we think the DXY could test resistance at 96.80. The bearish trend signals include the Ichimoku cloud crossing bearish, the 50wk and 12m SMA’s rolling over to a negative slope, MACD crossing below zero and a 16-month new low.

The weight of evidence leans toward selling into DXY strength in anticipation it falls to the high 80’s such as the 50% retracement.

For latest trades & forecasts from major banks, sign-up to eFXplus

Copyright © 2016 BofAML, eFXnews™Original Article