EUR/USD: Make Or Break At The Lower Bound Of Consolidation Zone – SocGen

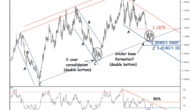

EUR/USD tentatively probed median of the broad range in force since 2015 at 1.0860 last week and has shown a retracement towards the lower limit of a down sloping channel at 1.0540/1.0465.

More importantly it is now Read More →