The Australian dollar strengthened against other major currencies in the Asian session on Tuesday, after the Reserve Bank of Australia kept its record low interest rate, as policymakers assessed the current stance as appropriate to maintain sustainable growth and to achieve the inflation target.

The board of the Reserve Bank of Australia, governed by Philip Lowe, decided to retain the cash rate at 1.50 percent. The bank had reduced the rate by 25-basis points each in August and May.

According to the RBA's central scenario, economic growth is likely to be around 3 percent over the next couple of years.

Meanwhile, Asian stock markets are mostly lower amid continuing uncertainty about the impact of U.S. President Donald Trump's economic policies. News that a federal judge halted Trump's executive order on immigration added to the recent uncertainty about the travel ban, also weighed on the Stock markets.

In economic news, data from the Australian Industry Group showed that the construction index in Australia continued to contract in January, albeit at a slower pace, with a Performance of Construction Index score of 47.7. That's up from 47.0 in December.

Monday, the Australian dollar showed mixed trading against its major rivals. While the Australian dollar rose against the Canadian dollar, it fell against the yen and the NZ dollar. Meanwhile, the aussie held steady against the U.S. dollar and the euro.

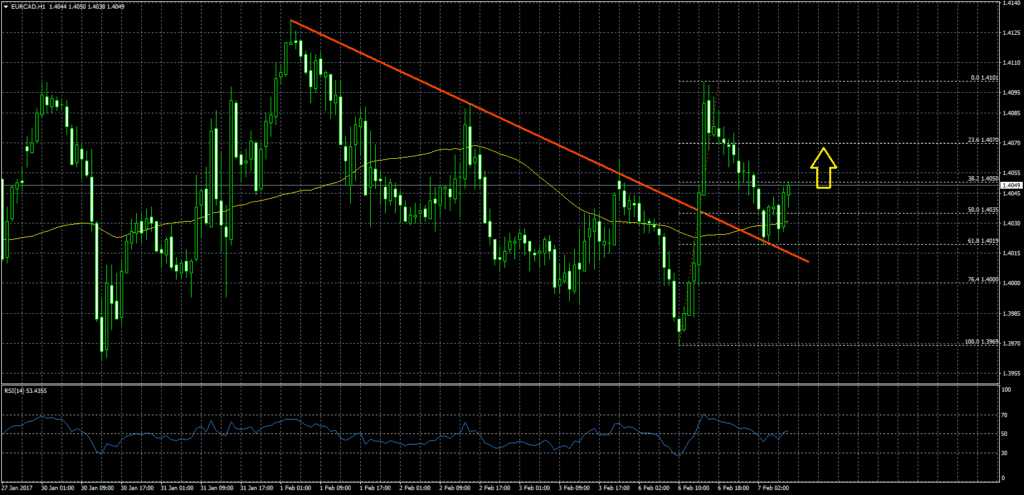

In the Asian trading, the Australian dollar rose to nearly a 2-year high of 1.3948 against the euro and a 2-week high of 1.0059 against the Canadian dollar, from yesterday's closing quotes of 1.4031 and 1.0019, respectively. If the aussie extends its uptrend, it is likely to find resistance around 1.38 against the euro, and 1.02 against the loonie.

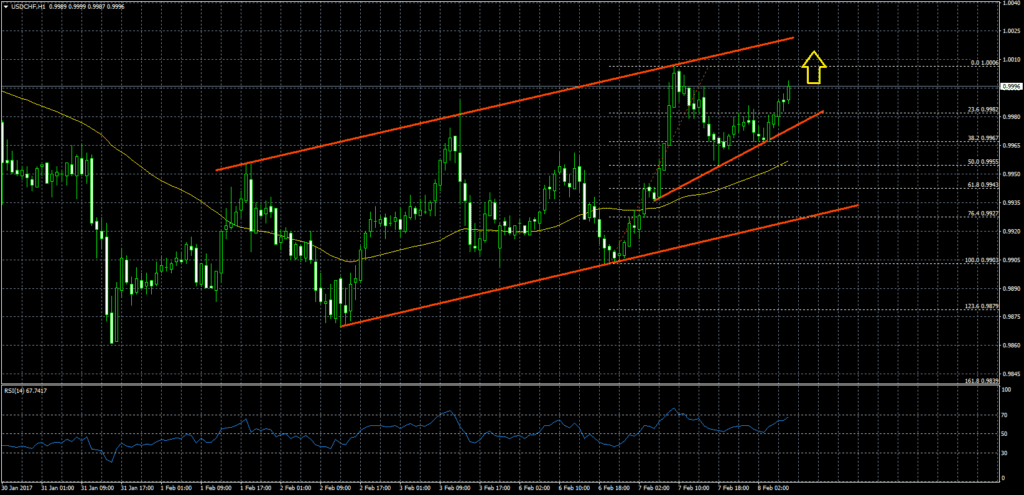

Against the U.S. dollar, the aussie advanced to 0.7679 from yesterday's closing value of 0.7658. The aussie may test resistance around the 0.78 region.

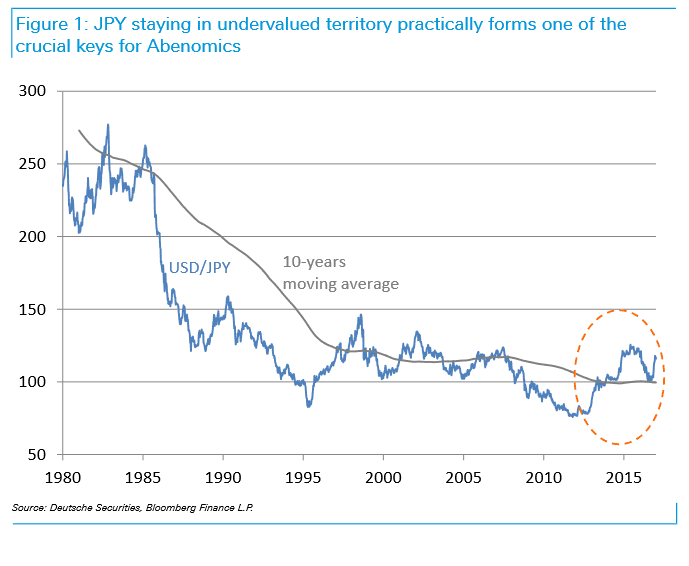

The aussie climbed to 85.89 against the yen, from an early 1-week low of 85.24. On the upside, 0.88 is seen as the next resistance level for the yen.

Meanwhile, the counter antipodean currency, the NZ dollar, fell against its major rivals after the RBA rate decision.

The NZ dollar rose to nearly a 3-month high of 0.7375 against the U.S. dollar, nearly a 2-year high of 1.4535 against the euro and a 6-day high of 1.0379 against the Australian dollar, from yesterday's closing quotes of 0.7321, 1.4679 and 1.0458, respectively. If the kiwi extends its uptrend, it is likely to find resistance around 0.75 against the greenback, 1.44 against the euro and 1.03 against the aussie.

Against the yen, the kiwi advanced to a 4-day high of 82.51 from an early 2-week low of 81.61. On the upside, 84.00 is seen as the next resistance level for the yen.

Looking ahead, U.K. Halifax house price index for January is set to be published at 3:30 am ET.

At 7:00 am ET, New Zealand's Global Dairy Trade is due to be held.

In the New York session, U.S. and Canada trade data, U.S. consumer credit and Canada building permits- all for December and Canada Ivey's PMI for January – are set to be announced.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Forex News