Fundamental Forecast for Australian Dollar: Neutral

Australian Dollar Recovers as RBA Cements Policy Outlook, Risk Recovers

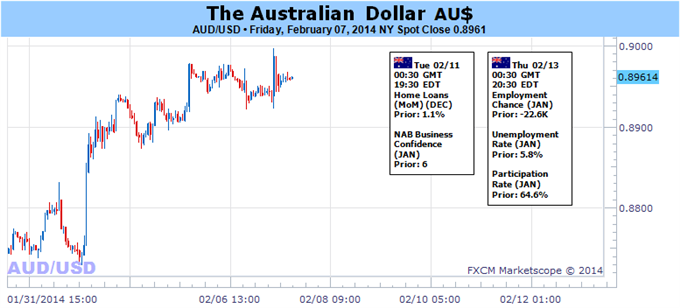

Fed Chair Yellen’s Testimony the Key Driver for Aussie in the Week Ahead

Help Time Key Turning Points for the Australian Dollar with DailyFX SSI

The Australian Dollar produced its strongest rally in four months last week, adding 2.39 percent against its US namesake. On the domestic front, the currency reveled in the outcome of the RBA monetary policy announcement, where Governor Glenn Stevens and company seemingly buried any lingering interest rate cut expectations. Meanwhile, risk appetite staged an impressive recovery, helping to support confidence-geared assets including the Aussie. The benchmark S&P 500 stock index touched the lowest level since mid-October early in the week but prices swiftly recovered to produce their first positive five-day run in a month.

Curiously, improving sentiment came against a backdrop of disappointing US economic data, an outcome that might have been expected to weigh on risk appetite considering Federal Reserve officials have staunchly dismissed the likelihood of a slowdown in the QE “tapering” cycle despite soft news-flow. With RBA policy seemingly locked in place, next week’s Australian employment data is unlikely to be trend-defining. With that in mind, understanding the logic behind the seemingly counter-intuitive state of affairs on the sentiment front is critical in mapping out where the Aussie goes from here. As it stands, there are two compelling narratives that may help to explain investors’ chipper disposition.

First, the US unemployment rate fell to 6.6 percent in January, putting it within a hair of the Fed’s 6.5 percent guidance threshold. While policymakers have uniformly spoken out against slowing QE reduction, they’ve likewise talked up the availability of other tools at their disposal. In this context, it is conceivable that investors are now betting that the FOMC’s commitment to scale back asset purchases represents a change in the way stimulus is delivered rather than the abandonment of accommodation in general, with a downward revision in the target jobless rate being the next policy step ahead.

Alternatively, it may be possible that investors have simply become complacent in the face of fading tail risk. Recent flare-ups in the emerging markets space seem to be far more transitory than the kind of tectonic threats facing investors as recently as the last two years (notably, the Eurozone debt crisis and the US budget impasse). Having priced in these temporary jitters, investors may have found comfort in supportive comments from both ECB and Fed policymakers in the last 48 hours of last week and scaled back on anti-risk bets after S&P 500 futures net short positioning hit an eight-month high .

Looking ahead, Congressional testimony from newly-minted Fed Chair Janet Yellen will help establish which (if any) of these scenarios is closest to reality. If she mentions the flexibility of the guidance framework and stresses the availability of other stimulus tools, the Aussie may rise as sentiment strengthens further. If her rhetoric is perceived as hawkish however, the situation becomes clouded. Either the markets will take her optimism at face value and continue driving the Aussie higher along with risk appetite, or be disappointed and reboot risk aversion. Only time will ultimately tell where we go from here. – IS

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx