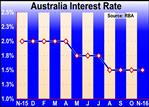

Australia's central bank kept its key interest rate unchanged at a record low as policymakers assessed the current stance as appropriate to maintain a sustainable growth and to bring inflation to the target.

The board of the Reserve Bank of Australia governed by Philip Lowe kept the cash rate at 1.50 percent. The bank had reduced the rate by 25-basis points each in August and May.

Taking account of the available information, and having eased monetary policy at its May and August meetings, the Board judged that holding the stance of policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time, the bank said in a statement.

Subdued growth in labor costs and very low cost pressures elsewhere in the world mean that inflation is forecast to remain low for some time.

The forecasts for output growth and inflation were little changed from those of three months ago, the bank noted.

Over the next year, the bank expects the economy to grow at close to its potential rate, before gradually strengthening. Inflation is forecast to pick up gradually over the next two years.

The inflation outlook is unlikely to be the source of any future policy adjustment, Bill Evans at Westpac Institutional Bank said.

With inflation only likely to track along the bottom of the 2-3 percent target band next year there will be scope to ease further should growth, and the labor market in particular, profoundly disappoint, he added.

Labor market indicators continue to be somewhat mixed. The forward-looking indicators suggest continued expansion in employment in the near term.

The bank observed that low interest rates have been supporting domestic demand and the lower exchange rate since 2013 has been helping the traded sector.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Economic News

What parts of the world are seeing the best (and worst) economic performances lately? Click here to check out our Econ Scorecard and find out! See up-to-the-moment rankings for the best and worst performers in GDP, unemployment rate, inflation and much more.