Australia's central bank kept its record low interest rate unchanged, as widely expected, on Tuesday.

The board of the Reserve Bank of Australia, governed by Philip Lowe, maintained the cash rate at 1.50 percent. The outcome of the meeting came in line with expectations.

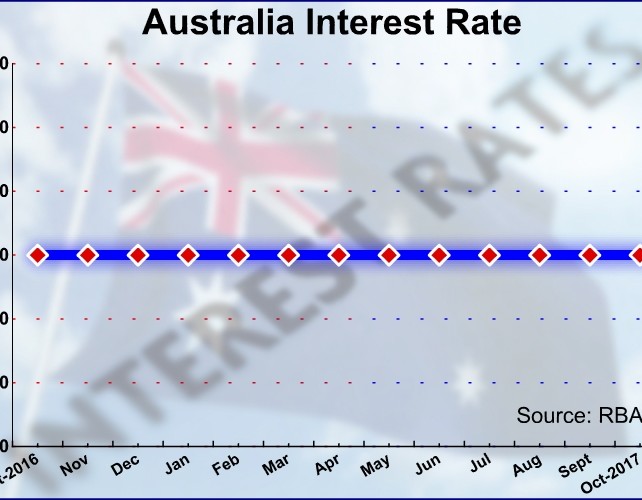

The interest rate has been at this level since September 2016. The bank had reduced the rate by 25-basis points each in August and May last year.

"Taking account of the available information, the Board judged that holding the stance of monetary policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time," the bank said in a statement.

The bank reiterated that the low level of interest rates is continuing to support the Australian economy.

Further, policymakers noted more consistent signs of non-mining business investment picking up.

The bank expects inflation to pick up gradually as the economy strengthens. According to RBA, the unemployment rate will decline only gradually over the next couple of years.

An appreciating exchange rate would be expected to result in a slower pick-up in economic activity and inflation than currently forecast. It is also weighing on the outlook for output and employment.

It appears that the RBA is expecting to raise rates sometime in 2018, Westpac economist Bill Evans, said.

With conditions in the housing market easing, and inflation and growth remaining sub-trend, there is no immediate urgency to move any sooner, the economist added.

On housing market, the bank observed conditions vary considerably around the country. Housing prices have been rising briskly in some markets, while in others they have been declining.

Following some tightening in credit conditions, growth in borrowing by investors slowed a little recently, the bank said.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Business News