Chinese exports declined by 4.1% last May, the figure was worse than expected. Japan upped its final reading for Q1 annualised GDP to 1.9% from a previosuly reported 1.7%. Sentiment throughout the Asian session looked mixed with the major equity indices also showing mixed performances.

AUDUSD held well above 0.74 levels after the RBA left rates unchanged yesterday at 1.75% in line with expectations. Even the CAD found support as the price of oil reached fresh highs above the 50$ mark.

The USD remained weak after Friday’s massive declines, after the US reported much weaker NFP numbers. The US dollar index is trading at 93.75 at the time of wirting with the next intraday support at 93.15.

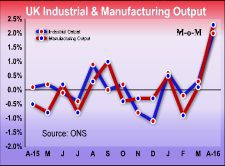

Later today the UK is expected to report Industrial and Manufacturing Production, bu the limelight will likely go to the the RBNZ rate decision expected overnight. Consensus figures are pointing at no change to the current policy rate of 2.25%.