Talking Points:

– AUD/USD Outlook Mired by Bearish RSI Divergence, Slowing China.

– USDOLLAR Extends Losses; Another Round of Fed Rhetoric on Tap.

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the “Traits of Successful Traders“ series.

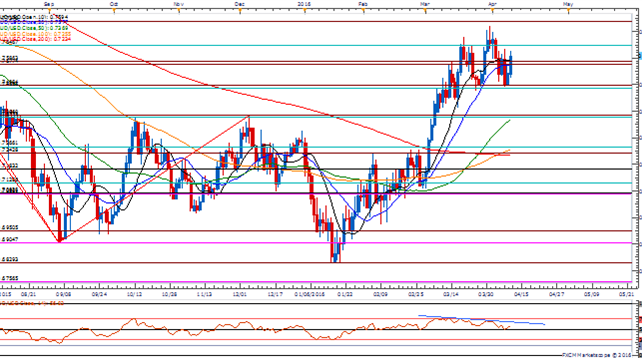

AUD/USD

Chart – Created Using FXCM Marketscope 2.0

- AUD/USD may continue to consolidate ahead of Australia’s Employment report, which is anticipated to show another 17.0K expansion in March as the pair continues to find near-term support around 0.7490 (61.8% retracement) to 0.7500 (61.8% expansion).

- However, as China, Australia’s largest trading partner, is anticipated to grow at a slower pace during the firsts three-months of 2016, fears of a ‘hard-landing’ may dampen the appeal of the Australian dollar especially as the Reserve Bank of Australia (RBA) keeps the door open to further assist with the rebalancing of the real economy.

- As the Relative Strength Index (RSI) preserves the bearish formation carried over from the previous month, the exchange rate may stay capped around 0.7740 (78.6% expansion), with the pair at risk of a head-and-shoulders formation.

- The DailyFX Speculative Sentiment Index (SSI) shows the retail FX crowd has flipped back net-short AUD/USD on April 8 after the ratio hit an extreme reading of -2.00 in March.

- The ratio currently stands at -1.25 as 44% of traders are long, with open interest 6.7% below the monthly average going into the second full-week of April.

Why and how do we use the SSI in trading? View our video and download the free indicator here

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

USDOLLAR(Ticker: USDollar):

|

Index |

Last |

High |

Low |

Daily Change (%) |

Daily Range (% of ATR) |

| DJ-FXCM Dollar Index |

11842.67 |

11887.3 |

11824.86 |

-0.29 |

105.73% |

Chart – Created Using FXCM Marketscope 2.0

- The USDOLLAR struggles to retain the range-bound price action from the previous week even as U.S. Retail Sales are projected to rebound in March, while the Consumer Price Index (CPI) is expected to highlight sticky price growth in the world’s largest economy.

- Beyond the key data prints, fresh rhetoric from Dallas Fed President Robert Kaplan, Philadelphia Fed President Patrick Harker, San Francisco Fed President John Williams, Richmond Fed President Jeffrey Lacker, Atlanta Fed President Dennis Lockhart, Chicago Fed President Charles Evans and Fed Governor Jerome Powellmay dampen the appeal of the greenback as the central bank officials appear to be in no rush to normalize monetary policy.

- Need a break/close below near-term support coming in around 11,826 (61.8% expansion) to 11,843 (38.2% retracement) to open up the next downside region of interest, which comes in around 11,745 (50% retracement) to 11,759 (23.6% retracement).

Click Here for the DailyFX Calendar

Read More:

Copper Breaks Key Support

USD/CAD Technical Analysis: Bearish Evidence Continues To Build

WTI Crude Oil Price Forecast: Is Momentum About to Breakout?

Largest Long Position for Gold Trend Followers Since November 2012

Get our top trading opportunities of 2016 HERE

— Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David’s e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

[ad_2]