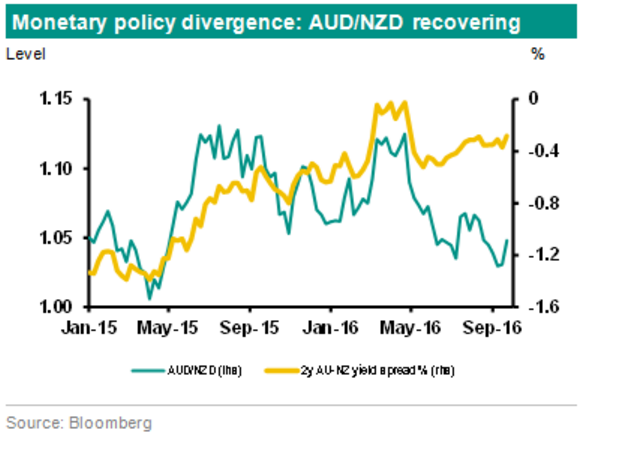

The AUD has outperformed the NZD in the past week as financial markets are coming to terms that the Reserve Bank of Australia (RBA) is likely to keep monetary policy unchanged this year, while another 25bp rate cut is still expected in New Zealand. Earlier this week, RBA governor Lowe said that the RBA is not an ‘inflation nutter’ and some degree of variability in inflation is inevitable and appropriate. This has raised the hurdle rate of policy easing in the coming months even if inflation in the third quarter remains below the RBA’s 2-3% target range. On the other hand, the Reserve Bank of New Zealand reiterated that further policy easing will be required to ensure that future inflation settles near the middle of their target range.

As monetary policy divergence in Australia and New Zealand is not fully priced in by financial markets, it is likely that AUD/NZD will continue to grind higher towards 1.07 in the coming weeks.

Copyright © 2016 ABN AMRO, eFXnews™Original Article