Key Points

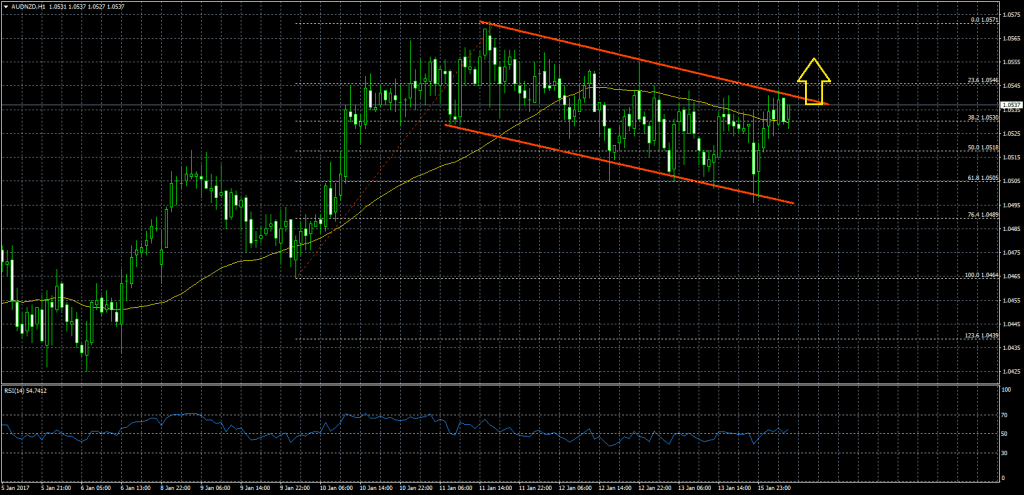

- The Aussie Dollar remained elevated against the Kiwi Dollar, but struggling to clear the 1.0550-1.0570 resistance.

- There is a descending channel formed on the hourly chart of AUDNZD, which is taking the pair slowly down towards 1.0520.

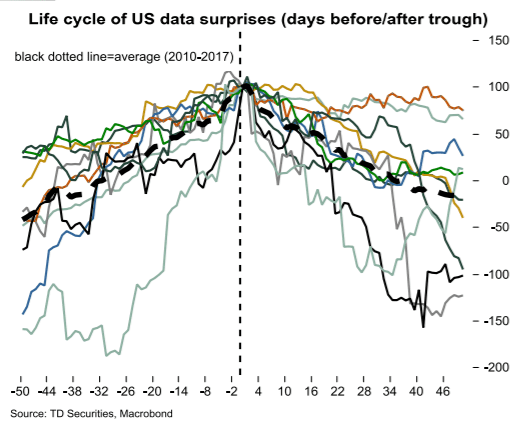

- Today in Australia, the TD Securities Inflation was released by The University of Melbourne – Faculty of Economics and Commerce.

- The result was better, as there was an increase of 0.5% in Dec 2016, compared with Nov 2016.

AUDNZD Technical Analysis

The Aussie Dollar recently traded as high as 1.0571 against the Kiwi dollar where it found sellers and started moving down. There is a descending channel formed on the hourly chart of AUDNZD, which acting as a downside move catalyst and pushed the pair below 1.0550.

The pair is currently back higher, and attempting a break above the channel resistance area at 1.0545-1.0550. The pair is also above the 21 hourly simple moving average, which is a positive sign.

So, if there is a break above the channel resistance area, there could be a strong move towards the 1.0570 and 1.0600 in the short term.

Australian TD Securities Inflation

Today during the Asian session, the Australian TD Securities Inflation, which estimates inflation in the Australian economy was released by The University of Melbourne – Faculty of Economics and Commerce.

The result was better, as there was an increase of 0.5% in Dec 2016, compared with Nov 2016. When we have a look at the yearly change, there was an increase of 1.8% in Dec 2016, compared with the same month a year ago.

Overall, it looks like the market is favoring the Aussie dollar at the moment, but it needs to break the 1.0550 and 1.0570 resistance levels for further upsides.