Key Points

- The Aussie dollar declined recently against the New Zealand Dollar, and traded below 1.0600.

- There was a bullish trend line formed on the hourly chart of AUDNZD, which was broken at 1.0630 to initiate a downside move.

- Today, the Australian Employment Change was released by the Australian Bureau of Statistics.

- The market was expecting a change of 20K in Oct 2016, but the outcome was lower as it came in at 9.8K.

AUDNZD Technical Analysis

The Aussie dollar after trading near 1.0660 against the Kiwi dollar for some time failed to gain momentum. As a result, there was a downside move, and the AUDNZD pair broke a bullish trend line formed on the hourly chart at 1.0630.

During the downside move, the pair also cleared the 38.2% Fib retracement level of the last leg from the 1.0398 low to 1.0660 high.

The pair is currently trading near a major support area at 1.0530. It is a crucial pivot area, and also coincides with the 50% Fib retracement level of the last leg from the 1.0398 low to 1.0660 high. A break below it could ignite more losses in AUDNZD.

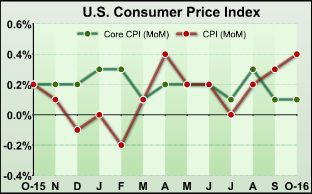

Australian Employment Change

Today, the Australian Employment Change, which is a measure of the change in the number of employed people in Australia was released by the Australian Bureau of Statistics. The market was expecting a change of 20K in Oct 2016.

However, the result was disappointing, as the change was 9.8K. The Australian Unemployment Rate remained stable at 5.6%. The report added that “Employment increased 9,800 to 11,938,900. Full-time employment increased 41,500 to 8,126,900 and part-time employment decreased 31,700 to 3,812,000. Unemployment decreased 2,000 to 705,100. The number of unemployed persons looking for full-time work increased 700 to 494,300 and the number of unemployed persons only looking for part-time work decreased 2,700 to 210,800”.

Overall, the Aussie dollar buyers may struggle in the short term, and there is a chance of more declines AUDNZD towards 1.0500.