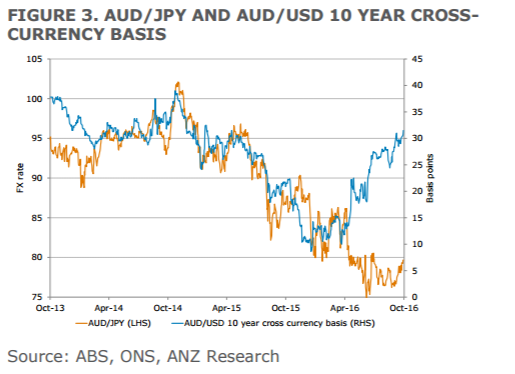

AUD/JPY has been a lot weaker than suggested by traditional drivers such as the AUD/USD 10-year cross-currency basis. We expect there are a few drivers behind this divergence.

First, SSA issuance in AUD has fallen 25% this year – reflecting a preference to issue in their home currency due to lower borrowing costs.

Second, Japanese demand for foreign bonds appears to be waning and the preference has shifted to lower-rated debt.

Third, the demand for USD has driven funding costs higher and borrowers targeting the AUD market have not responded to the attractive level of the cross-currency basis curve.

Lastly, higher domestic rates in Japan are keeping domestic money onshore.

These dynamics are unlikely to shift for the moment, and that should limit any upside in AUD/JPY for now.

That said, the substantial involvement of Japanese accounts in the 30 year ACGB (Figure 2) suggests Japanese investors’ behaviour may be shifting once again and as such weekly portfolio flows will need to be watched closely for any signs of a shift

Copyright © 2016 ANZ, eFXnews™Original Article