Fundamental Forecast for Australian Dollar: Neutral

AUD/USD Rebounds As Local Data Recovers Amidst Return To Yield

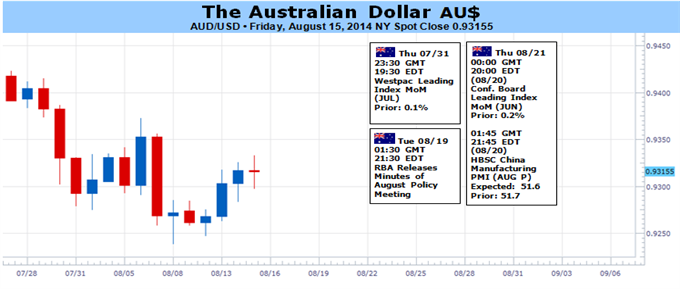

RBA Minutes and Chinese PMI Figures To Offer Regional Event Risk

Path of Least Resistance Remains For The Pair To Stay Range-Bound

The Australian Dollar managed to reclaim lost ground over the week to finish marginally higher. A lift in local business and consumer confidence figures offered a positive signal for the domestic economy and kick started the Aussie’s recovery. Further gains were afforded by a broad return to high-yielding instruments as traders looked past disappointing Chinese economic data and Ukrainian tensions eased.

Over the coming week, the RBA’s August Meeting Minutes and the HSBC China Flash Manufacturing PMI data are the most noteworthy pieces of regional event risk for the Aussie. The Reserve Bank has held steadfast in its preference for a ‘period of stability’ for rates and the Minutes are unlikely to reveal any major revelations. In the absence of a more dovish tone from the central bank the Aussie could remain elevated.

Meanwhile, another upside surprise to the Chinese manufacturing data could offer the Aussie a source of support. A string of recent improvements in the leading indicator have helped alleviate fears of a further deceleration in economic growth within the Asian giant. A rebound in Chinese economic data bodes well for the Australian economy via the two country’s close trading ties.

Geopolitical tensions will likely remain in the background over the coming week. Although the embers of the latest flare-up are still glowing, the Australian Dollar may continue to demonstrate resilience in the absence of a material escalation of regional conflicts.

The scarcity ofsentiment-shifting regional catalysts over the coming week suggests the Australian Dollar’s path of least resistance may be for it to remain range-bound between 92 and 95 US cents. Refer to the US Dollar outlook for insights into how the USD side of the equation may influence the pair.

Written by David de Ferranti, Currency Analyst, DailyFX

To receive David’sanalysis directly via email, please sign up here

Contact and follow David on Twitter: @DaviddeFe

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx