USD strength in 2017 should take the AUD towards the 70c mark, but if the RBA cuts rates this would make a move sub 70 much more likely.

Risks to our AUD outlook are tilted to the downside. If commodity prices give back all of their H2-16 gains and the Fed undertakes more than 2 hikes in 2017, then AUD risks ending next year closer to 65c than 70 cents.

The balance of risk favours NZD/USD moderating next year, but the NZD is seen either holding its ground or rising in cross-rate terms. NZ domestic factors remain positive and although core inflation is seen on a mild upward trajectory, the market is likely to price in a rising chance of an H2-2017 tightening as the year progresses.

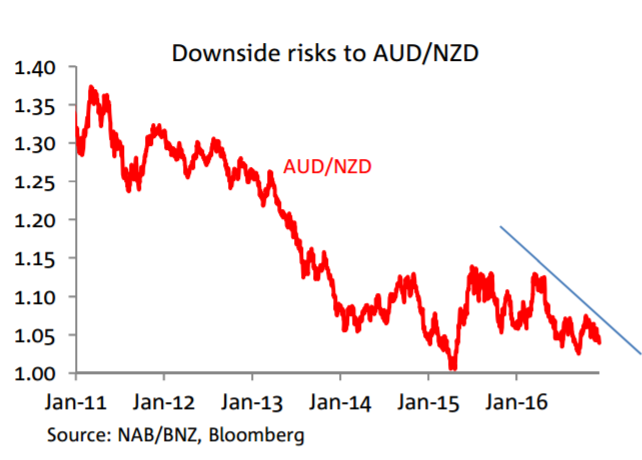

Our base case is for AUD/NZD to trade through parity in 2018, but given that we are more positive on NZ’s economic prospects relative to Australia, the risk is that this may happen sooner, rather than later.

Copyright © 2016 NAB, eFXnews™Original Article