The past week, especially Friday, was good for the U.S dollar on the one hand, but on the other hand, turned out to be a nightmare for the equity and bond markets. While the greenback advanced against most of its peers, fueling the dollar index to a higher close, settling at 95.38, up 0.38% on the day. European and U.S stocks however, posted their biggest daily losses since the Brexit selloff.

The Dow Jones fell 2.1%, to 18085.45, S&P 500 declined 2.45% to 2127.81, and Nasdaq Composite lost 2.54% to close at 5215.91, after European shares finished the week lower. The U.K.’s FTSE 100 was down 1.19% over the week, while the French CAC index and the German DAX ended the Friday session around 1% lower.

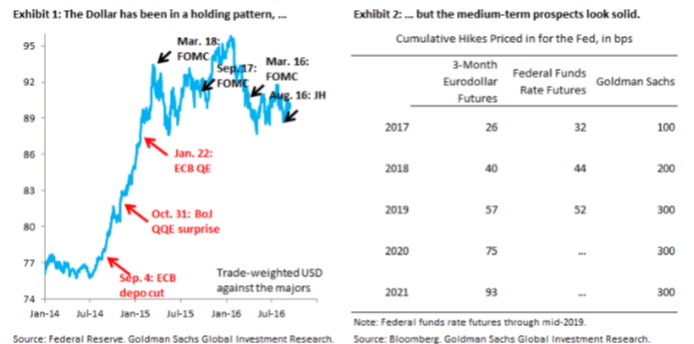

Revived speculation over a U.S interest rate increase as soon as this month helped boost the dollar and created fears of a trend towards tightening monetary policy that would negatively impact investors holding shares in general and shares of dividend payers like utilities and telecommunications companies, as the opportunity cost of holding shares increases.

Among comments made by Fed officials on Friday, statements by Boston Fed President Eric Rosengren, heightened market volatility the most. Rosengren is a voting member of the Fed’s policy committee and therefore will have a say in the Fed’s decision.

Having advocated low rates in the recent past, and widely considered to be a dovish member, Rosengren stated that “based on data that we have received to date…a reasonable case can be made for continuing to pursue a gradual normalization of monetary policy”. The FOMC voter echoed hawkish statements by other Fed Members recently, by warning over the risks of waiting too long to tighten and confirmed that the economy is performing quite well with the labor market nearing full-employment and inflation slowly returning towards the 2% target.

Until the monetary policy meeting scheduled on September 20-21, there will be only one more speech by any Fed Member ahead of the blackout period for public comments by Fed Members. The central bank’s most dovish official, Governor Lael Brainard, will be delivering a previously unannounced speech on Monday at The Chicago Council on Global Affairs.

Last week, three central bank meetings were concluded with no new policy changes announced. Reserve Bank of Australia decided to stand pat on interest rates on Tuesday and Bank of Canada maintained its overnight rate at 0.5% as anticipated, but the European Central Bank disappointed markets even though it left the rates unchanged.

The ECB had been expected to extend its asset purchase program of buying €80 billion worth of bonds a month, beyond the March 2017 end-date, but ECB President Draghi stated that policy makers didn’t even discuss any fresh stimulus measures and gave no explicit guidance about the central bank’s next moves.

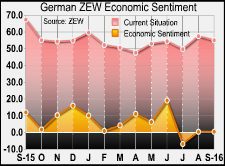

Eurozone data released in the past week was disappointing – with service-sector activity stagnating around a 19-month low, industrial production plunging and inflation being stuck near zero and showing no signs of coming close to the central bank’s target of 2%. In the coming week, the German ZEW Economic Sentiment survey, Eurozone trade balance and EU CPI(August Final) are on the calendar of data releases, but none of these releases are expected to be major market movers for the euro.

The British Pound will be in focus next week with a chain of data being released before the Bank of England’s monetary policy announcement. Most of the data released recently are considered to be broadly indicative of the outlook for the British economy, for a full month after the Brexit vote. The data readings, especially readings from the service sector that have pointed to an expansion, have mostly been above expectations, indicating the limited impact of Brexit on the country’s economy.

Data on inflation, employment and retail sales is due to be reported in the coming week. The U.K. Office for National Statistics will publish data on consumer price inflation for August on Tuesday, monthly jobs report on Wednesday, and data on retail sales on Thursday.

Chinese industrial production and retail sales data by the National Bureau of Statistics is scheduled to be released on Tuesday. Markets expect factory output to have risen by 6.1% last month, after increasing by 6.0% in July, while August’s retail sales are forecast to report a growth rate similar to the July rate of growth at 10.2%.

These numbers could impact the AUD and NZD, as China is their largest trading partner. Dairy prices continue to rise helping the Kiwi to outperform the Aussie and are creating pressure on the AUD/NZD cross, taking it to the lowest level since late April 2015.

In the week ahead, the main focus for the New Zealand dollar will be second-quarter GDP data, which is expected to report the strongest performance since the last quarter of 2013. A positive reading will push the NZD higher across the board, and pave the way for the AUD/NZD pair to retreat further.

The Swiss National Bank’s quarterly policy assessment is due on Thursday with most economists expecting the central bank’s benchmark interest rate to remain unchanged at -0.75%. According to Reuters, the SNB will stick to its commitment towards foreign currency interventions in order to reduce demand for the franc.

In the energy markets the focus remains on Oil. Oil prices tumbled on Friday but closed the week higher, fueled by Russia and Saudi Arabia’s commitment to work together to help rebalance the markets and a surprisingly large drawdown in U.S. crude stocks.

U.S. Energy Information Administration confirmed a huge draw-down in U.S. crude inventories on Thursday. The surprise development had been reported first on Wednesday by the API. Government data showed that U.S. crude stocks dropped by 14.5 million barrels last week to 511.4 million barrels – the biggest weekly drop in stockpiles since January 1999.

Crude prices may receive further support next week, as U.S oil producers could be hit by a delay in the North Dakota oil pipeline construction. Following ongoing protests from environmentalists and Native American tribes, the U.S. Justice Department asked operators of the Dakota Access pipeline to suspend construction along a 40-mile (64 km) stretch in North Dakota on Friday. With the suspension, local oil producers and shippers are facing the possibility of greater delays in setting up a quick route to ship oil to the Gulf of Mexico.

For the week ahead, oil traders will be focusing on U.S. oil supplies data on Tuesday by the American Petroleum Institute, data on stockpiles by the U.S. Energy Information Administration on Wednesday, and U.S. oil rig count by Baker Hughes on Friday for fresh supply-and-demand balance signals.