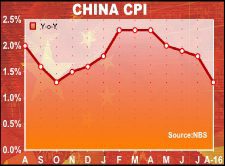

Inflation in China slowed to the lowest since October 2015 even as the over 4-year slump in factory gate prices slowed, providing scope for additional policy easing a day after trade data vouched for some momentum going on in the Chinese economy.

Nevertheless, some economists see the easing as a transitory development and that the central bank may still be restrained by credit risks facing the economy.

Inflation eased to 1.3 percent in August from 1.8 percent in July, the National Bureau of Statistics said Friday. A similar lower rate was last seen in October 2015. Economists had forecast the rate to slow marginally to 1.7 percent.

Food inflation slowed to 1.3 percent in August from 3.3 percent in June. Meanwhile, non-food inflation held steady at 1.4 percent.

On a monthly basis, consumer prices edged up 0.1 percent in August after rising 0.2 percent in July. This was the second consecutive increase in prices.

Producer prices dropped 0.8 percent annually following a 1.7 percent drop in July. Prices were expected to decline 0.9 percent.

This was the slowest decline since early 2012, with the pace of decrease slowing for the eighth straight month.

While some will likely argue that the fall in headline CPI increases the likelihood of further monetary easing by the People's Bank, Julian Evans-Pritchard at Capital Economics doubts it will make a great deal of difference.

It is concerns over credit risks, not inflation risks, that is keeping the PBOC on hold, he added.

The economist suspects that the fall in consumer prices in August will prove short-lived and that inflation will edge back up over the coming months.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Economic News

What parts of the world are seeing the best (and worst) economic performances lately? Click here to check out our Econ Scorecard and find out! See up-to-the-moment rankings for the best and worst performers in GDP, unemployment rate, inflation and much more.