Sterling On A Slide After Strong Start Sideways Bias To Reign Until Market Close

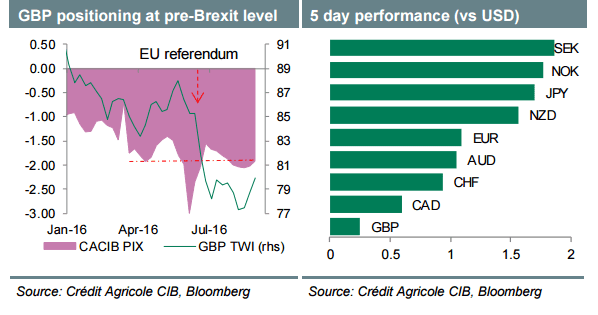

GBPUSD was trading flat on Friday, and looked set to close the week not far from the opening price. The pair had a great beginning to the week, but failed to hold on to its strength. The British Pound has pared most of its gains against the U.S dollar and is trading cautiously around the key level at 1.32900 following data showing that the U.K construction sector stagnated in July.

Figures from the Office for National Statistics published on Friday indicated that the country’s construction output in July remained unchanged from June, while economists had expected a decline of 1.0% on a month-on-month basis after contractions in the past two months. A 1% fall in house building activity was offset by a 3.9% rise in infrastructure activity which was bolstered by £1.5 billion of new infrastructure projects. Compared to one year ago, the industry slowed down by 1.5%.

Most of the data released recently are considered to be providing a broad-based outlook for the economy for a full month after the Brexit vote. The data readings have mostly been above expectations barring Wednesday’s manufacturing output data. The U.K economy seems to be holding up better than expected, but British firms are likely to cut investment during the rest of this year and in 2017 due to Brexit related unertainty, the Institute of Chartered Accountants in England and Wales said.

The ICAEW predicted that business investment would fall by 2.9 percent in 2016 and a further 3.7 percent in 2017, reversing a 5 percent rise in 2015, as companies are responding to June’s referendum with more caution.

While new finance minister Philip Hammond is likely to give his first budget statement in November, Prime Minister Theresa May is preparing to begin negotiations with European Union leaders over the terms of the U.K.’s exit from the trading bloc.

The ICAEW also lowered its economic growth forecast to 1.1 percent in 2017, down from 1.8 percent this year, and updated its unemployment rate predictions to 5.3 percent from 5.1 percent in 2016. Wage growth is expected to edge up to 1.7 percent, helped by the introduction of a new higher minimum wage.

The dollar seems to be losing some momentum against most of its peers after a sharp rally on Thursday which was driven by a rebound in oil prices.

Investors are shifting their focus now to the meeting of the U.S Federal Reserve later this month. Despite a chorus of Fed officials including President Janet Yellen and her top Deputy Stanley Fisher signaling that the time to hike rates is approaching as the economy is at or near the full-employment level, investors have trimmed bets that the Fed would be raising rates as early as this month, especially after recent data echoing the disappointment of a smaller-than-expected NFP last Friday.

GBPUSD is trading sideways above the support at 1.32900 and has been stuck between the two moving averages. While the MA20 is placed above the price action and pushing the price downwards, the MA50 is placed below the price action and supporting the market to head higher. In the last session before the weekend, sideways trading is expected to continue going into the weekly close, if there is no major shock from the fundamental side.

Trade suggestion

Buy Digital Put Option from 1.33140 to 1.32900 valid until 20:00 GMT September 09, 2016