A disappointing US ISM Non-Manufacturing yesterday did little damage to equity sentiment, major US equity indices were positive at close. Asia turned mixed this morning however.

USDJPY keeps heading south as we speak, and is currently trading at 101.44 at the time of writing. The currency pair enters its third consecutive day of losses as the JPY takes the lead after the weaker US data, seen since last Friday, made the case for a September hike less relevant.

USDJPY has dipped below daily support of 101.37 hitting session lows of 101.20 but has so far managed to consolidate just above the first daily support. According to our TraderTip daily outlook next support to the donwside lies at 100.72, but if 101.37 holds it is likely we see a grind higher to 102 + levels especially if the BoJ shows signs it may give in to the mounting pressure to do something about the general economic conditions.

So far albeit ready to take further action if needed, it seems Japanese policymakers stand divided and in fact last Monday Kuroda failed to provide any explicit hints. The stronger Yen left its dent on the Japanese Nikkei’s performance today, with the inverse relationship between the JPY and the Nikkei continuing to take shape.

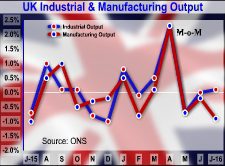

On the economic data front, Australian Q2 GDP on the Y/Y basis, was better than the previous reading and in line with the expected 3.3%. We have some medium impact data out of Europe this morning with Germany and the UK reporting industrial and manufacturing production. The limelight will go the the BoC rate decision later this afternoon. BoC is expected to stay on hold at 0.50%.

The CAD was pretty flat this morning against both the USD and the Euro.