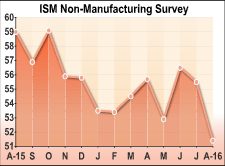

Service sector growth in the U.S. slowed to its slowest rate in over six years in the month of August, according to a report released by the Institute for Supply Management on Tuesday.

The ISM said its non-manufacturing index tumbled to 51.4 in August from 55.5 in July, falling to its lowest level since February of 2010.

While a reading above 50 indicates continued growth in the service sector, economists had expected the index to show a much more modest drop to 55.0.

"According to the NMI, 11 non-manufacturing industries reported growth in August," said Anthony Nieves, chair of the ISM Non-Manufacturing Business Survey Committee.

He added, "The majority of the respondents' comments indicate that there has been a slowing in the level of business for their respective companies."

The drop by the headline index came as the business activity index slumped to 51.8 in August from 59.3 in July and the new orders index plunged to 51.4 from 60.3.

The report also said the employment index dipped to 50.7 in August from 51.4 in July, indicating only slight job growth in the service sector.

The prices index also edged down to 51.8 in August from 51.7 in the previous month, although the reading above 50 indicates price growth for the fifth consecutive month.

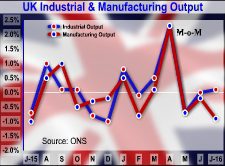

Last Thursday, the ISM released a separate report showing that manufacturing activity in the U.S. unexpectedly contracted in the month of August.

The ISM said its purchasing managers index slumped to 49.4 in August from 52.6 in July, with the reading below 50 indicating the first contraction in manufacturing activity since February.

Economists had expected the index to show a much more modest decrease to a reading of 52.2, which would have still indicated growth in the sector.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Economic News

What parts of the world are seeing the best (and worst) economic performances lately? Click here to check out our Econ Scorecard and find out! See up-to-the-moment rankings for the best and worst performers in GDP, unemployment rate, inflation and much more.