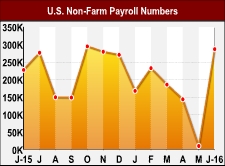

After reporting only modest job growth in the previous month, the Labor Department released a report on Friday showing a much bigger than expected increase in employment in the month of June.

The report said non-farm payroll employment surged up by 287,000 jobs in June versus economist estimates for an increase of about 180,000 jobs.

However, the Labor Department also said the uptick in jobs in May was downwardly revised to just 11,000 from the 38,000 originally reported.

The weak job growth in May was partly due to a since-resolved strike by Verizon (VZ) workers, which contributed to the loss of 39,000 jobs in the information sector.

With Verizon workers returning to the job, the information sector added 44,000 jobs in June, contributing to the stronger than expected job growth.

Notable job growth also occurred in the leisure and hospitality, health care and social assistance, and financial activities sectors.

Despite the strong job growth during the month, the unemployment rate rose to 4.9 percent in June from 4.7 percent in May. Economists had expected the rate to edge up to 4.8 percent.

However, the uptick in unemployment rate reflected a rebound in the number of people in the labor force, which soared by 414,000 people in June after plunging by 458,000 people in May.

The report also said the household survey measure of employment increased by 67,000 jobs in June after rising by 26,000 jobs in the previous month.

On the wage front, the Labor Department said average hourly employee earnings rose by $0.02 to $25.61 in June after rising by $0.06 in May.

Compared to the same month a year ago, average hourly earnings have risen by 2.6 percent, reflecting the strongest wage growth this year.

Andrew Hunter, Assistant Economist at Capital Economics, said the strong job growth in June suggests the sharp slowdown in the preceding months was nothing more than a blip.

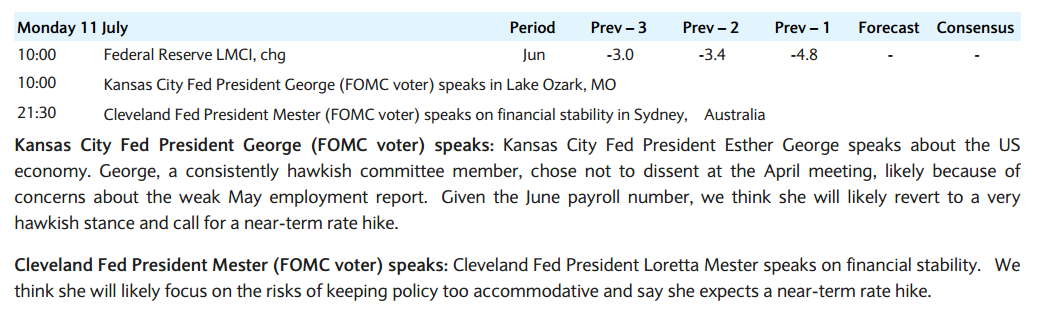

"Fed officials will want to see evidence of a more sustained recovery in employment growth over July and August as well, but this nonetheless supports our view that the next hike could still be in September," Hunter said.

The Federal Reserve is scheduled to hold its next policy meeting later this month, but most analysts expect the central bank to remain on hold following Britain's recent vote to leave the European Union.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Forex News