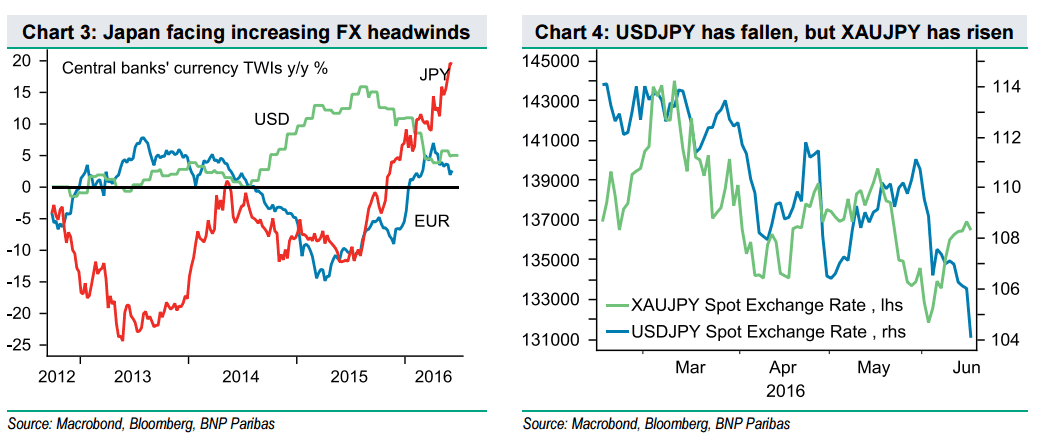

The FOMC left rates on hold, lowering growth forecasts and the projections in the ‘dot-plot’ for Fed Funds. The BOJ also left rates on hold and the yen has rallied sharply. US equities initially reacted positively to the Fed’s dovish tone but suffered a late swoon that is reflected in EM currencies reversing yesterday’s gains too. Risk sentiment can’t be forever bolstered by a timid Fed, and the legacy of this move seems to me to be increased nervousness about the global economic outlook.

The BOJ sounded optimistic about the domestic environment but more concerned about the global one, which is partly a code for concerns about China, partly a reference to the yen, which just powers on. At some point MOF/BOJ will respond to yen strength but are still bruised after the BOJ miss-handled the move at the end of January and intervention is more likely the other side of USD/JPY 100 than this side

Tactically, for now, short GBP/JPY looks the best trade out there for anyone who can manage the volatility and has a horizon of less than a week.

Copyright © 2016 Societe Generale, eFXnews™Original Article