At the June meeting of the FOMC, which concluded yesterday, FED President Yellen stated that the target range for the benchmark rate would be kept unchanged at 0.25% to 0.5%. This decision met markets’ expectations – based on rising concerns regarding “Brexit” weighed on global financial markets, and a slowing of the US labour market in May, clouded growth perceptions for the US economy.

In response to the central bank’s decision and the subsequent press conference by the Fed Chief, the Dollar index DXY declined to a low of 94.33, shrugging off an advance of 0.75% on Wednesday.

Data released by the Statistics Canada on June 15 showed that at the beginning of second quarter in 2016, the turnover from manufacturers jumped up 1.0% in April compared to March. This comes after declines for two consecutive months. The positive reading was mainly a result of an increase in sales in 10 out of 21 industries, which represent 55% of Canadian manufacturing sales. In particular, sales in the petroleum and coal product industry rose by 8.3% in April, while the transportation equipment sector witnessed an increase of 2.1% in the same period.

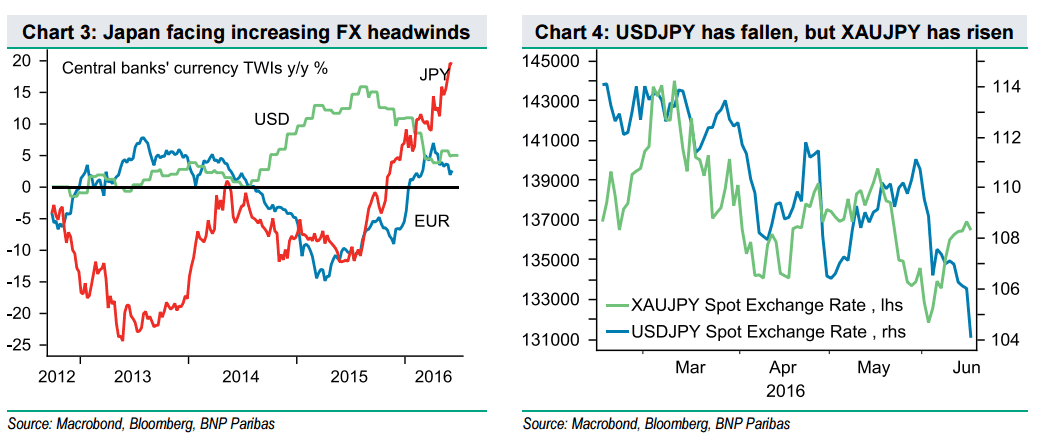

Earlier today, the Bank of Japan decided to maintain an unchanged monetary policy, despite weak inflation and sluggish global growth. The Nikkei average immediately edged down 2.2% to a two-month low of 15,576.60.

Oil prices inched up slightly in the Asian trading session on Thursday, after the Energy Information Administration reported that US crude stockpiles fell by 0.9 million barrels in the week ending on June 10. West Texas Immediate crude currently trades at $47.59/barrel, up almost 50 cents from the last settlement.

Technicals

EURUSD

The euro is charting an up-move against the US dollar since the FOMC decision on maintaining its benchmark rates and the subsequent press conference. The two moving averages have already crossed over the price chart, putting upward pressure on the pair to fly higher. The price is expected to break through the 38.2% level of Fibonacci retracement although this is a solid resistance and it has restrained the Euro from surging for more than a week. Thereafter the pair may test the 50.0% level before hitting firm resistance.. A pull back is expected from there.

Trade suggestion

Buy Digital Call Option from 1.12853 to 1.13190 valid until 20:00 June 17, 2016

GBPAUD

GBPAUD is currently locked in a narrow range, around the area of the 61.8% Fibonacci retracement. ADX (14) registers at 47.5374, with DI- far higher than DI+, showing that bear power is still dominant. Besides, the two moving averages hang over the price chart, still casting a shadow on the pair. The support of 1.88868 is forecast to be tested, and then a bounce back may occur.

Trade suggestion

Buy Digital Put Option from 1.91398 to 1.90157 valid until 20:00 June 17, 2016

USDJPY

The Japanese yen has been gradually getting stronger against the greenback in the last two weeks. The price chart shows that lower lows were created at a rapid pace, which means that the bear is taking the lead in the price movement. ADX (14) is currently up to a very high reading, indicating that the current trend is very strong. A continuation of the declines may continue in the near future, and may lead the pair to test the area of 101.680

Trade suggestion

Buy Digital Put Option from 104.145 to 103.539 valid until 20:00 June 17, 2016

SILVER

A higher-than-70 reading of the RSI (14) indicates that the metal has entered into a strongly bullish market and is expected to pull back once buyers get exhausted. ADX (14) is at 27.6722, showing that the uptrend is still strong. The price may climb higher in the short-term, and may retest the resistance of 17.996, which was formed on May 02. A downtrend could emerge from that point onwards.

BRENT

BRENT has been stuck in a very narrow range around the level of 48.92 since a while. The stochastics chart shows that the commodity has entered the oversold area and the %K line (blue line) is attempting to cross the %D line (red line), hinting that a reversal into an uptrend may occur. However, the price is anticipated to continue its down-move overall, being under pressure from the two moving averages above.

Trade suggestion

Buy Digital Put Option from 48.86 to 48.53 valid until 20:00 June 17, 2016

NASDAQ

NASDAQ is currently falling after meeting stiff resistance at 4442.60 yesterday. RSI (14) is moving downwards towards the threshold of 30, preparing to enter the oversold territory once again. This means that the bear’s power is still strong. Short positions are encouraged by the red trend indicator over the price chart that appeared last Friday. The current support of 4390.12 may be broken.

Trade suggestion

Buy Digital Put Option from 4406.96 to 4378.97 valid until 20:00 June 17, 2016