In Asia this morning, the major equity inidices sold off as they took the negative cue from their US counterparts. The main culprit behind the negative sentiment was a pullback in oil prices after the latter had attained year’s highs recently.

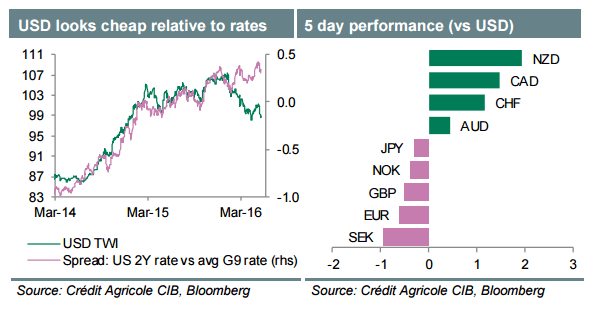

Sapping support for oil was the recent recovery seen in the value of the USD. The USD sold off considerably throughout the past week, shedding at least 2.72% from end of May highs, but it was seen recovering back some of the lost ground throughout Thursday and even this morning.

USD originally sold off after some dismisal NFP numbers last week, numbers that made another Fed rate hike less iminent although still in the horizon. Now since oil is priced in USD, the recovery seen since yesterday has somewhat hurt some of the original support that oil was finding.

The US Dollar index attained the 94 levels yesterday and has managed to hold well so far. Needless to say the gains in the USD were mirrored on the EURUSD as declines as the euro started to lose its earlier shine. EURUSD is currently trading at 1.1293 levels.

The major impact data out of today’s economic calendar comes from Canada, that is expected to release its May Unemployment rate. Later on today as well we have the Michigan Consumer Sentiment.