Early on Thursday, the Reserve Bank of New Zealand disappointed expectations for an interest rate cut, deciding to stand pat. The NZ benchmark rate was kept unchanged at 2.25% for the third straight month. The Kiwi immediately made a big move to surge to a one-year high of 0.71380 against the greenback.

The Office for National Statistics yesterday released data on UK production for April. Data came in with an annual growth of 1.6% in total production output, thanks to the gains in all 4 main sectors, especially the 0.8% increase from manufacturers’ activity. A bright signal from the economy has buoyed the pound to trim the losses versus the euro, to climb up to 0.78705 in today’s Asian trading session.

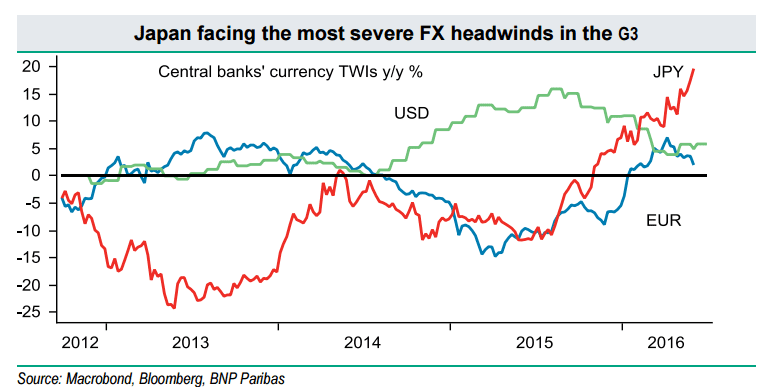

Meanwhile, Japan’s Cabinet Office on Thursday’s morning announced that core machinery orders in April witnessed a worse-than-expected fall of 11.0% in comparison with the previous period. This marked the largest plunge in the last two years.

Oil prices today, are still holding around a record peak, near the highest levels since the beginning of this year. Crude prices are flying high against a weak dollar and enjoying support from a drop in US crude inventories. The Energy Information Administration on Wednesday reported that the stockpiles for the week ending June 03 extended the draw downs of the past several weeks, falling by 3.2 million barrels as economists’ had forecast. The global benchmark, West Texas Immediate crude, is currently trading at $51.63/barrel, near the last settlement.

Technicals

EURUSD

After a brief consolidation, the euro resumed its upward movement against the greenback, leading the pair EURUSD to fly higher from the support of 1.13244 formed on Monday. ADX (14) has jumped to the reading of 59.5703, showing that the bullish trend is very powerful. Even though the price is facing stiff resistance at the 61.8% Fibonacci retracement, the distance between the two MAs has widened, signaling a possible break out. The price is anticipated to continue its up-move and a long position is suggested.

Trade suggestion

Buy Digital Call Option from 1.14015 to 1.42555 valid until 20:00 June 11, 2016

GBPAUD

GBPAUD is extending its downtrend since the end of May having failed at the resistance of 2.04369. The pair has plunged into the oversold territory since some time now, and is currently seeking an opportunity to reverse into an uptrend as RSI (14) is standing flat at 24.7571. However, the two moving averages, which hang over the price, still cast a shadow on the pair. Hence, the price is expected to hit the support of 1.92859 before rising up.

Trade suggestion

Buy Digital Put Option from 1.93620 to 1.92960 valid until 20:00 June 11, 2016

USDJPY

The red trend indicator hanging over the price chart has signaled a short position on the pair USDJPY since June 01. Though, a relatively high ADX (14) implies that the current trend is still strong, the pair has witnessed a significant move of 305 pips up to now as shown by the trend indicator. Thus, the downtick is expected to die down soon after the price hits the support of 106.104.

Trade suggestion

Buy Digital Put Option from 106.563 to 106.207 valid until 20:00 June 11, 2016

SILVER

After reaching a nine-week low of 15.798 early in June, SILVER has taken flight with support from the parabolics band below, to surge sharply higher. RSI (14) registers at 83.3925, indicating that the commodity has been in the overbought territory since a while. A reversal into a downtrend is likely to happen soon. However, the price could retest the resistance of 17.383. A long position in the very short-term is encouraged.

Trade suggestion

Buy Digital Call Option from 17.172 to 17.344 valid until 20:00 June 11, 2016

BRENT

Brent is witnessing a sharp up move, heading to six-month high at around 54.269. All the indicators are supporting the price surging higher. ADX has soared to 36.9072, with the +DI line far above the –DI line. The two moving averages also keep moving under the price with the distance narrowing. A breakout past the resistance of 54.269 is expected in the near term.

Trade suggestion

Buy Digital Call Option from 52.95 to 53.47 valid until 20:00 June 11, 2016

NASDAQ100

The bullish power of the NASDAQ100 seems to have been exhausted as the index currently seems stuck in a range between 4475.59 and 4544.72. RSI (14) hovers around the average, hinting no clear direction for the price movement. The trend indicator has suggested a long position since May 23, with a substantial move of 1440 pips. Hence, the index may continue trading in a range bound fashion for some time, before beginning a new trend.

Trade suggestion

Buy Digital Put Option from 4496.65 to 4444.52 valid until 20:00 June 11, 2016