Key Points

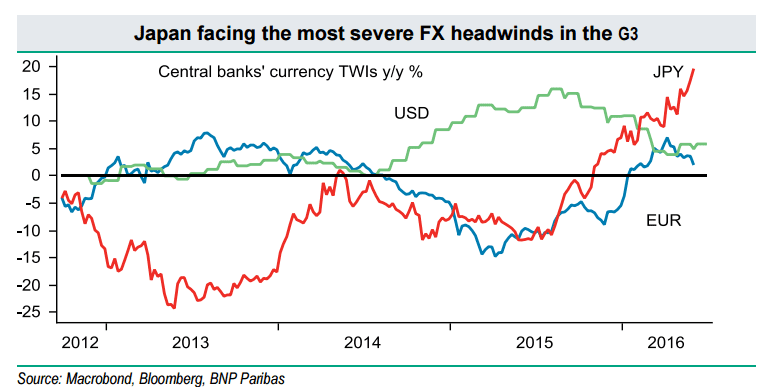

- Euro traded down vs the Japanese yen, and currently approaching a major break.

- There is a monster support trend line formed on the EURJPY pair, which if broken may ignite further losses.

- The Japanese Money Supply M2+CD released by the Bank of Japan posted a rise of 3.4% in May 2016, more than the forecast.

- The Foreign investment in Japan stocks released by Ministry of Finance posted a reading of ¥-175.3B.

Technical Analysis

The Euro after trading as high as 122.71 against the Japanese yen found offers and started to move down. The EURJPY pair also moved below the 50 hourly simple moving average, and currently testing the 100 hourly SMA.

Moreover, there is a bullish trend line formed on the hourly chart of EURJPY pair, which is currently acting as a support along with the 100 hourly SMA.

As long as the trend line and the 100 SMA is in play, there is a chance of a bounce in the pair. However, if the trend line is breached, then there might be more losses in EURJPY.

Japanese Money Supply M2+CD

Today in Japan, Money Supply M2+CD, which measures all the JPY in circulation, encompassing notes and coins as well as money held in bank accounts was released by the Bank of Japan. The market was expecting a rise of 3.3% in May 2016. However, the result was above the forecast, as there was an increase of 3.4%.

Moreover, the Foreign investment in Japan stocks released by Ministry of Finance registered an amount of ¥-175.3B.

It looks like the economic releases in the Euro Zone may drive the Euro and the EURJPY pair in the near term.