The JPY has been capped of late, mainly on the back of officials reaffirming that direct currency intervention as well as a more aggressive monetary policy stance cannot be excluded.

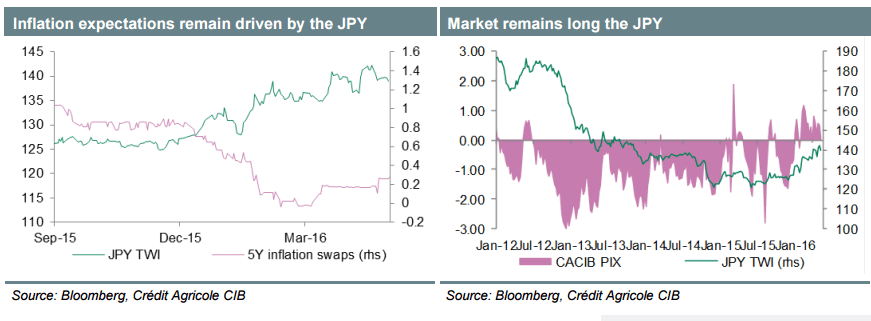

BoJ Governor Kuroda, for instance, stressed this week that they will not hesitate to add to stimulus should it prove necessary. When it comes to the risk of intervention, officials such as Finance Minister Aso repeatedly indicated that the currency has been dampening domestic conditions. Indeed, medium-term inflation expectations remain close to multi-year lows and keep a close correlation to the currency.

All of the above suggests that a combination of strongly capped monetary policy expectations and intervention risk should keep the JPY subject to position squaring related downside risks, especially as the risk of going down the rout of competitive devaluation should be regarded as relatively low.

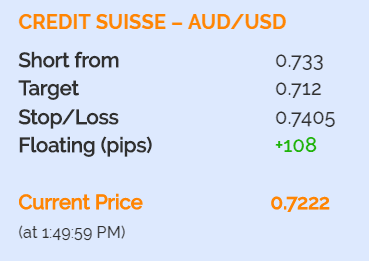

As a result of the above outlined conditions we stick to the view that the currency should be sold on rallies, for instance against the EUR. We stay long the cross.

*This trade is recorded tracked and updated in eFXplus Orders.

For latest trades & forecasts from major banks, sign-up to eFXplus

Copyright © 2016 Credit Agricole CIB, eFXnews™Original Article