Key Points

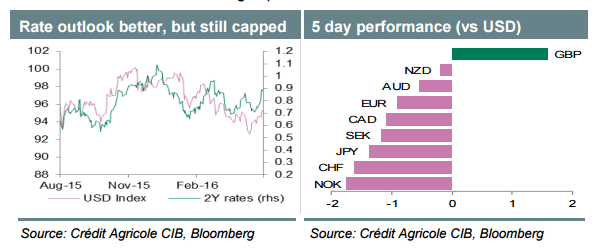

- The Aussie Dollar was under a lot of pressure vs the Kiwi dollar and the US Dollar, as the economic data in Australia missed the expectation.

- There is a bearish trend line formed on the 4-hours chart of the AUDUSD pair, which is acting as a selling zone for sellers.

- Employment Change released by the Australian Bureau of Statistics registered a reading of 10.8K in April 2016, missing the forecast.

- The participation rate came in at 64.8%, compared with the forecast of 64.9%.

Technical Analysis

The Aussie dollar recently broke a major support area of 1.0700 vs the NZ dollar, and traded towards 1.0660. There is a bearish trend line formed on the 4-hours chart of the AUDUSD pair, which acted as a hurdle for the Aussie dollar buyers and pushed the pair down.

It looks like the pair may continue to trade lower and test the 1.618 extension of the last wave from the 1.0704 low to 1.0809 high.

One may even consider selling AUDNZD as long as the pair is below the trend line resistance area.

Australia’s Employment Report

Today in Australia, the Employment Change report was released by the Australian Bureau of Statistics. The market was expecting the measure of the change in the number of employed people in Australia to post a reading of 12.5K in April 2016. However, the outcome was a bit lower, as the change came in at 10.8K.

The report added that “Unemployment increased 400 to 723,300. The number of unemployed persons looking for full-time work remained steady at 515,000 and the number of unemployed persons only looking for part-time work increased 400 to 208,200”.

Overall, the result was not encouraging, and as a result, there was a downside move in the AUDNZD and AUDUSD pairs.