The dollar soared to a three-week high against the yen on Thursday, after FOMC minutes from the Federal Reserve's last meeting raised hopes for an interest rate hike in June. USD/JPY rose to 110.38 overnight, recording a rebound of almost 4.5 percent from its 18-month low of 105.55 hit earlier in the month. The pair is now off its highs trading at 110.05.

EUR/USD fell to 1.1205, its lowest since March 29. The dollar index, which tracks the greenback against a basket of six major currencies, climbed to a seven-week high of 95.33.

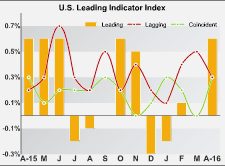

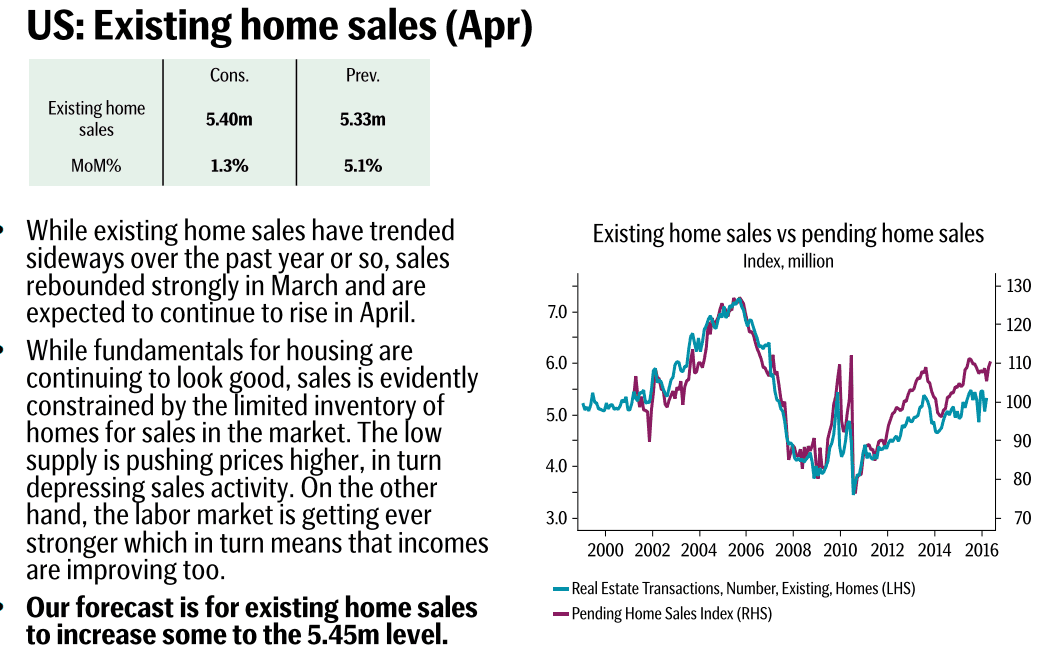

Economic data published earlier this week showed inflation in the US increased the most in three years in April while industrial output and housing starts both rebounded, suggesting the economy was regaining steam at the start of the second quarter after almost stalling early in the year.

The Aussie slipped to a two-and-a-half month low after mixed Australian jobs data overnight, which sparked some speculative selling despite the fact the numbers were unlikely to build the case for an imminent rate cut by the Reserve Bank of Australia.

AUD/USD fell to 0.7191, its lowest level since early March. The Aussie dollar last traded above 0.7200, down around 0.4 percent,

Equity markets fell overnight, weighed by a stronger dollar and prospects of higher rates in the US. Japan's Nikkei erased gains of more than 1 percent to finish flat but Hong Kong's Hang Seng index fell 0.75 percent and in mainland China the Shanghai and Shenzen Composite finished 0.15 and 0.45 percent lower respectively.

Commodity prices were also under pressure given the hawkish tone by the Fed. Gold is down more than 2 percent from yesterday's peak, trading at $1'255.70 per ounce. WTI Crude oil dropped below $48 per barrel after hitting a high above $49 yesterday.