A weaker yen pushed Japanese shares higher, but regional benchmarks were weighed by weaker Chinese trade data. Wall Street shares closed the day higher on Friday after the headline job number from the US missed expectations.

Oil prices were higher on Monday as a huge wildfire in Canada knocked out more than a million barrels per day of production. Meanwhile Saudi Arabia ousted veteran oil minister Ali al-Naimi in a surprise move which has so far failed to weigh on prices.

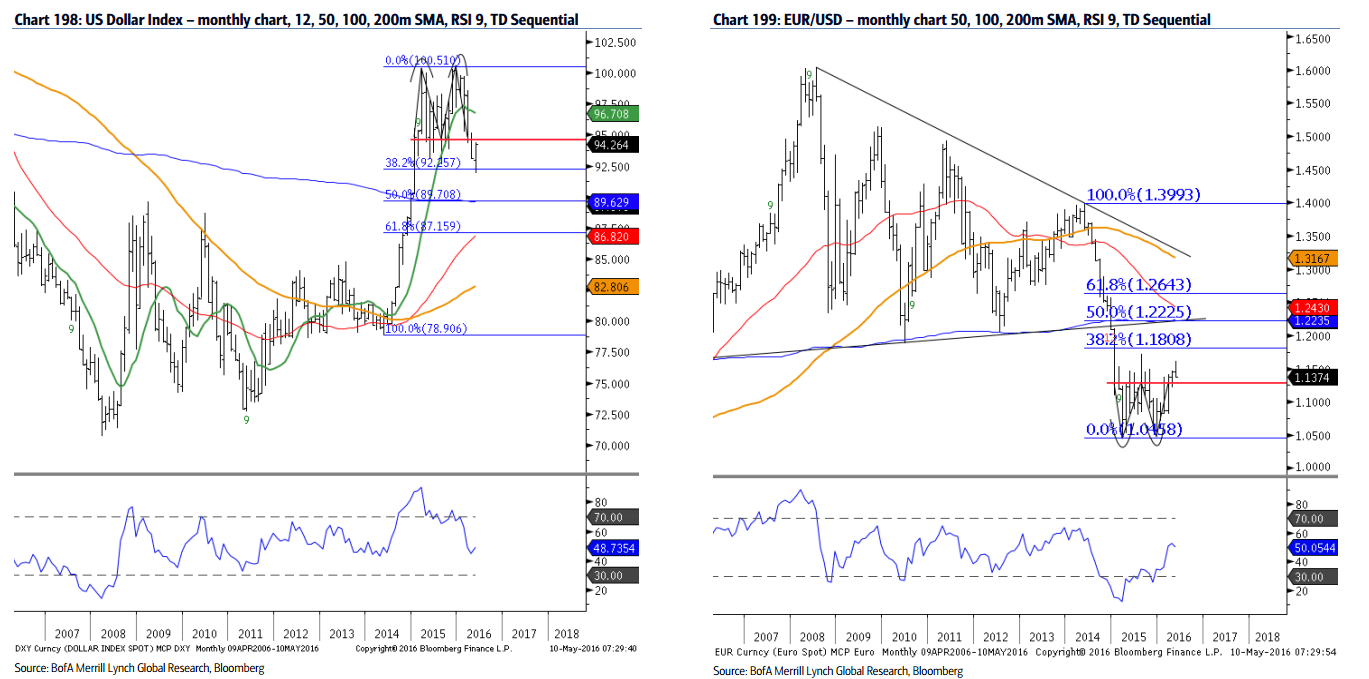

The dollar has attracted forex investor's attention over the past week, following a break and a test of lows not seen since August 2015. The Dollar Index was flat so far on Monday but has advanced in four straight sessions and looks poised for a fifth straight gain.

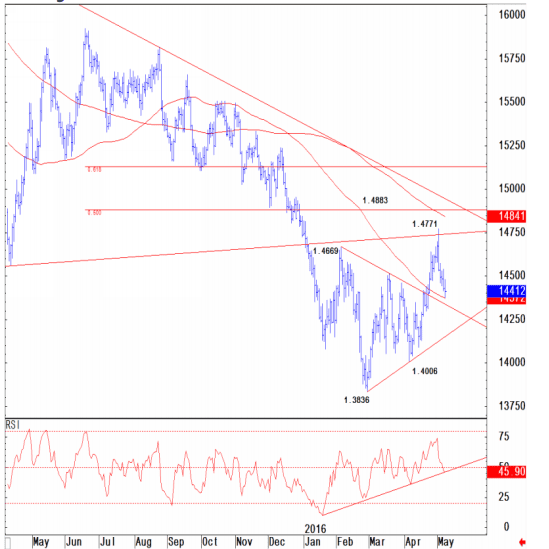

USD/JPY edged higher on Monday following a choppy end to last week, advancing 0.35 percent to 107.46 at the time of writing. The greenback was buoyed on Friday despite a lackluster jobs report which showed non-farm payrolls grew 160'000 against expectations for above 200'000. However, y/y average hourly earnings figure rose to 2.5 percent which was seen to shore up the buck.

EUR/USD traded below 1.1400, at 1.1388 down 0.13 percent while the Aussie continued its decline from recent ten-month highs. AUD/USD fell to 0.7338 at the time of writing following sluggish Chinese trade data.