According to Samara Cohen, head of BlackRock’s ETF division, most of the demand for Bitcoin arises from investment vehicles like ETFs, rather than direct purchases on cryptocurrency exchanges.

Cohen noted that 80% of purchasers of Bitcoin ETFs are individual investors, with 75% being first-time buyers of BlackRock’s iShares offerings.

The combined market capitalization of all 11 spot Bitcoin ETFs has exceeded $63 billion, alongside nearly $20 billion in inflows. Over the past five trading days, spot Bitcoin ETFs have experienced over $2.1 billion in net inflows, with BlackRock accounting for half of this figure.

Bitcoin recently reached its highest price since July, trading above $68,300 and closing Q3 with a remarkable 140% increase year-over-year. Cohen pointed out that their initial goal was to inform ETF investors about cryptocurrency, but they ended up educating crypto investors on the advantages of ETFs.

New Bitcoin ETF Options

On Friday, the U.S. Securities and Exchange Commission (SEC) expedited approval for 11 exchange-traded funds (ETFs) to offer options linked to spot Bitcoin prices on the New York Stock Exchange (NYSE).

This marks a significant advancement for institutional investors, as Bitcoin options present a flexible and efficient means for hedging and increasing exposure to Bitcoin.

These options provide investors with a method to speculate on or hedge against risks associated with Bitcoin’s price fluctuations in a regulated environment, requiring less capital than trading the underlying asset directly.

Bloomberg analyst Eric Balchunas remarked on this historic moment for the crypto market. He indicated that the SEC had recently granted similar approvals for Nasdaq, so this news was not a significant surprise, though it is still positive for the crypto landscape.

Nonetheless, actual listings will still require additional time, as the new options must receive approval from the CFTC, according to Balchunas.

Bitcoin Returns Exceed Expectations

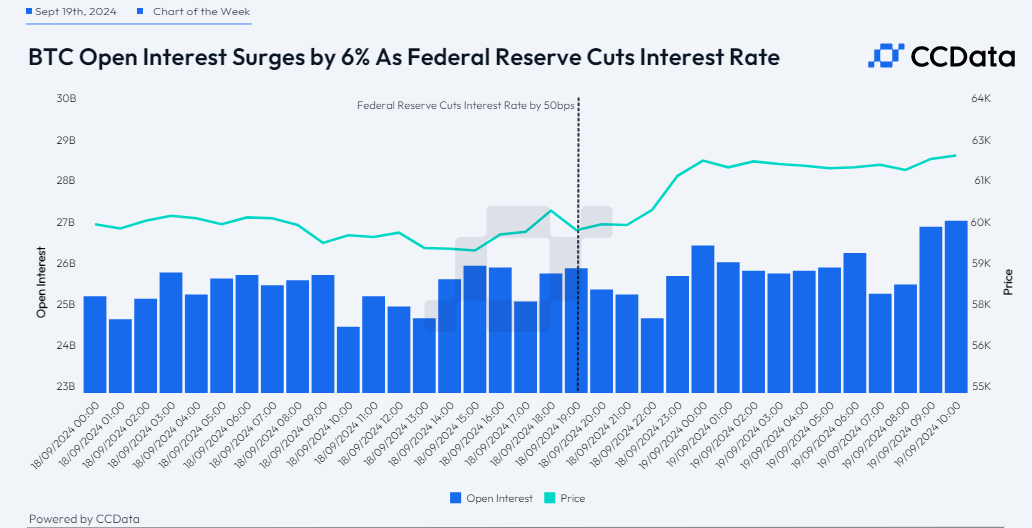

Bitcoin concluded Q3 with a modest 1.00% gain, rebounding after dipping below $50,000 in August, as per CCData. With Q4 approaching, market sentiment has turned optimistic, bolstered by historical data showing an average return of 49.9% in Q4 since 2014.

This positivity is supported by changes in market conditions following the Federal Reserve’s recent interest rate cut of 50 basis points. This adjustment enhanced market activity, leading Bitcoin’s overall open interest to rise 6% to nearly $27 billion.

Bitcoin’s price surged beyond $62,000, demonstrating a robust bullish reaction, while altcoins also performed well, surpassing U.S. equities, which experienced turbulent movements.

This outperformance in the cryptocurrency market indicates that liquidity injections may soon follow, as interest rate cuts typically signal macroeconomic weakness after a prolonged period of tightening.

If additional economic stimulation is necessary, risk-on assets like Bitcoin are poised to reap the most benefits, with upward momentum likely to persist in the near future.